CEO Ali Dibadj provides an update on the three macro drivers we believe will shape markets in the second half of 2025 and how Janus Henderson is helping clients position for a brighter investment future.

Several years ago, we set out the three macro drivers that we believed investors needed to focus on to navigate change and position themselves over the years to come. These were: geopolitical realignment, demographic and lifestyle shifts, and the return of the cost of capital. The three themes were central to the thinking of our 350 investment professionals around the world and guided us in answering vital asset allocation questions to help clients position for a brighter future. We had conviction in their importance then, and even more so now.

Geopolitical realignment

If 2024 was the year of elections, 2025 is the year of policy change. Tariffs have shaken markets and made it clear that geopolitical risk must be factored into investment decisions. Inter-state tensions have risen, international norms of conduct have weakened, and the fuse for escalation has shortened.

Companies and investors must now be prepared for tactics that span sanctions, tariffs, and currency shifts, as well as cyberattacks and espionage. Research shows that countries were exposed to three times as many geopolitical risk events in 2024 as they were in 20101 – a systemic trend that will have intensified in 2025. This backdrop gives businesses and investors, especially active investors like us, much to analyze and position for.

Heightened security risk and the fragility of the NATO Alliance are leading to a focus on resilience, with governments emphasizing national infrastructure, defense, and security. Europe in particular is aiming to reduce external dependencies and strengthen its own industrial and defense capabilities, while countries worldwide are bolstering military capacity and procurement.

At a trade level, the push for “strategic autonomy” is driving protection of supply chains, with governments incentivizing domestic production and moving to control adversaries’ access to critical goods and technologies. This breakdown in economic linkages, and the accompanying distrust it engenders, makes for an even more significant geopolitical realignment than we anticipated two years ago.

What does this mean for investing? From our perspective, it means developments must be actively monitored and analyzed, with our investment teams viewing geopolitics as an important investment lever. A thorough testing of previously unlikely scenarios is now obligatory. We could see a move away from globalization toward “bloc-ization” of trade between more localized and politically aligned economic zones. The expanded BRICS bloc, for example, now accounts for over 35% of global GDP and over 40% of the world’s population.2 Identifying the likely winners of these adjustments at an early stage presents compelling opportunities for active investors.

Indeed, many of the clients we partner with are already looking at new opportunities to diversify their U.S. equity and fixed income allocations globally, particularly in Europe, the UK, Japan, Australia, and select emerging markets. At the same time they are reshaping their U.S. allocations to higher-quality opportunities that recent volatility has uncovered across all market caps levels.

Return of the cost of capital

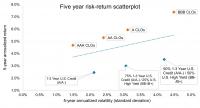

Within fixed income, yield is back. The US$3 trillion added to U.S. debt has a pronounced impact. And while the European Union’s move away from German-led austerity should help growth, it comes with increased borrowing – again potentially holding rates higher for longer. We believe fixed income investors could benefit from higher rates – providing rates move in an orderly fashion. The higher yields provide attractive entry points, and our conversations with clients, as well as industry flow numbers, show that meaningful allocations are being made.

As mentioned already related to equites, and noted in our fixed income outlook, there is appetite for diversification away from the U.S. into attractively priced, high-quality fixed income opportunities in the likes of Europe, Australia, and select emerging markets. An element of caution is also evident, with investors favoring the safer havens of investment grade, short duration, and securitized assets. For those seeking further diversification, private credit is proving interesting, particularly asset-backed lending and non-U.S. direct lending, with the diversification benefits it offers.

Demographics and lifestyle shifts

When we first introduced the demographics driver, the emphasis was on the choices people made in life and work post the COVID pandemic. This has evolved into how people and countries are harnessing innovation and technology to improve lives and productivity.

Our technology teams view tech as the science of solving problems, and the world is currently presenting ample opportunities on this front. They also believe that the next major wave of artificial intelligence (AI) remains in its early innings, providing exciting opportunities in the years ahead. Technology and AI are also revolutionizing healthcare, with innovation accelerating in biotechnology, potentially delivering huge improvements to people’s lives.

In asset management, innovation is also leading to shifts in the types of investment products people are considering. We engaged in conversations with clients across the world about how they’d like to harness this innovation to fortify their portfolios and gain better access to powerful secular themes. This led to a broadening of our successful exchange-traded fund (ETF) offering from the U.S. into Europe, Asia Pacific, Latin America, and the Middle East, as well as the launch of an innovative tokenized fund that provides access to U.S. Treasury bills using blockchain technology. These developments reflect our focus on bridging the gap between traditional and decentralized finance and offering access to investment products in new ways.

Partnering with clients for a brighter investment future

With so much uncertainty at a macro level, clients are understandably seeking expert insight and suitable solutions. This is no longer an environment in which to simply put money in a passive index or a levered vehicle. The new backdrop presents far more complexity and a much wider divide between which companies or securities will win and which will lose out. This suits active stock picking and highlights the value of diversified and geopolitically resilient strategies.

We have more than 90 years of experience in navigating change. Our investment teams across the world dynamically analyze opportunities daily to separate the wheat from the chaff on behalf of clients. As macro drivers meaningfully reshape our world, we are proud to be able to work together with clients to help them position for a brighter future.