Portfolio Managers John Kerschner, Nick Childs, and Jessica Shill discuss why they believe the strategic case for AAA CLOs remains compelling amid Federal Reserve (Fed) rate cuts.

Following a 9-month hiatus in its rate-cutting cycle, the Federal Reserve (Fed) recently resumed monetary easing, with cuts in September and October 2025 in response to signs of a softening labor market.

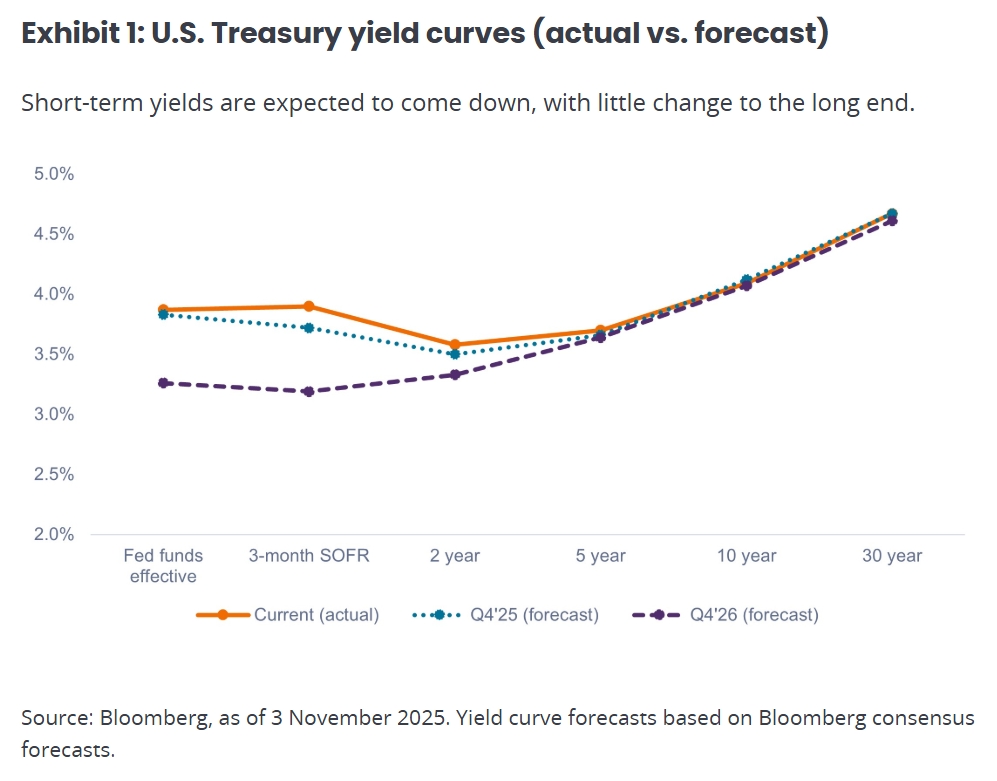

While earlier hopes for more aggressive rate cuts have not fully materialized – in part, due to stickier inflation under Trump 2.0 – the Fed is still on course to cut rates through 2025 and 2026, albeit at a far slower pace than what was being predicted in 2024. Futures markets are now anticipating just 78 basis points (bps) of rate cuts over the next 12 months, bringing the effective federal funds rate to roughly 3.00%, from the current 3.87%.

With the prospect of lower interest rates, investors may be asking the following questions:

Should I rotate out of short duration into long-duration bonds? If I do maintain an allocation to short duration, which sectors might best suit my investment goals? Should high-quality, floating-rate bonds still command a strategic allocation in my fixed income portfolio?

Why maintain an allocation to short duration through a rate-cutting cycle?

Historically, most of the move down in long-term yields has taken place before the Fed starts cutting, not after (i.e., long-term yields generally move in anticipation of rate cuts). The current cycle is no exception, with the 10-year U.S. Treasury yield rallying to 3.62% in September 2024 before backing up to around 4.1% in November 2025.

While long-term yields could rally further, the market is anticipating they will not do so unless we enter a recession or inflation falls much more than expected. As shown in Exhibit 1, short-term yields are projected to fall over the next year, with little change to 10-year and 30-year Treasury yields.

So what does this mean for investors, and what options do investors have for short-duration?

Read the full article here for our team's expert insights.