Cities across the world are at significant risk from climate change impacts. Blending physical risk modelling with social, financial and regulatory information will be the difference between prepared real estate investors, and those failing to adapt to climate threats.

Existing government and private sector commitments to greenhouse gas (GHG) emission reduction will not put the world on track to meet the essential target of keeping global temperature rise to below 1.5C. This is despite the pledges and efforts already made across sectors - such as across large parts of the real estate market – to achieve net zero carbon by 2050. In fact, the latest predictions are that without rapid, large-scale change to systems and infrastructure, the average global temperature could increase by around 2.8°C by the end of the century.

This poses a serious challenge for investors and asset owners, as the risks of losses and damages from climate change compound with every increment of global warming. Cities across the world are at significant risk from climate change impacts. The World Economic Forum suggests that the coming decades will be defined by “ex-cities and climate migrants”. The world could see up to 6.3 billion people living in urban centres by 2050, and estimates suggest there have already been 31 million environmental migrants globally. Estimates suggest that the cost to global cities from sea level rise and associated flooding alone could reach $1 trillion by 2050 (C40 Cities, 2018).

Hurricanes are already the most costly disaster category in the US, with losses of over $1 trillion in the last 40 years. These losses are expected to increase by 70% by the end of the century. With secondary impacts of rising utility costs, food insecurity, increased natural resource pressures and worsening climate- induced health risks, cities will be under extreme pressures to adapt. The impacts of severe climatic events are not new.

Significant effort is needed to better identify, interpret, and act on the physical risks facing the sector. The potential cost of inaction or maladaptation could lead to significant material and financial consequences, not just for the real estate owner, but transposing to the wider financial economy too. Investors need only consider bank collateral, pension portfolios, insurance premiums. Fast and effective action now could set leaders apart, but this is not just competition – collective action is essential given the scale and regional impact of the consequences, besides impacting individual assets at risk.

Identifying risk and resilience at regional, city and asset level

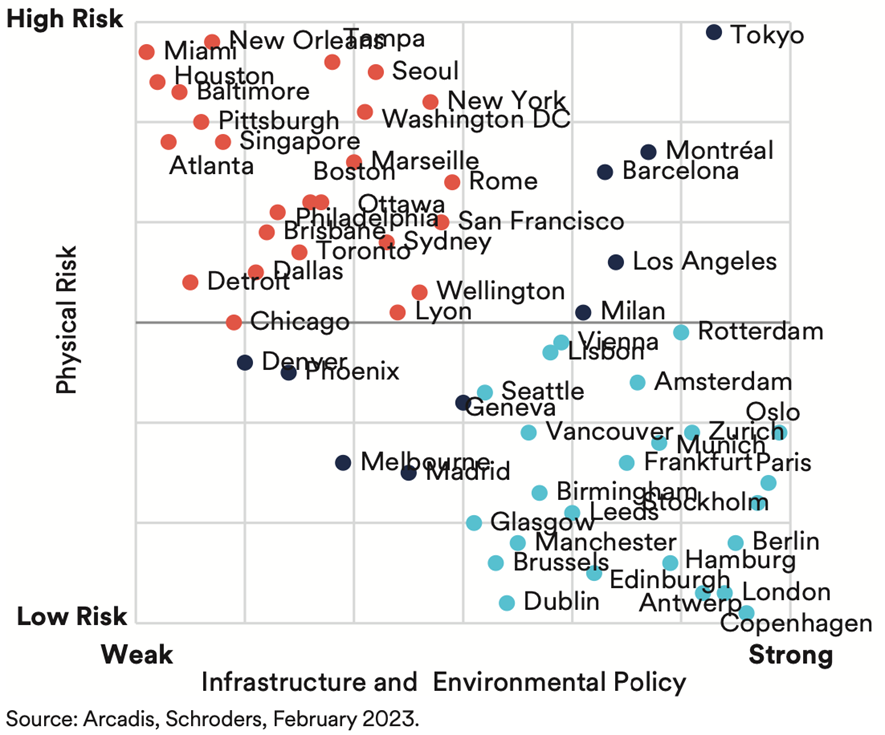

A lot is known – and models are available – of the predicted impacts of global warming around the world. Despite this, actually identifying which cities are most at risk from climate impacts can be challenging. When assessed at a regional level, it could be determined that cities in Europe are less at risk than in other regions (Figure 4), and are less exposed to extreme high temperatures, storms, droughts and disruption to agriculture. However, assessed at the local or asset level, the specific site and location of a city, or the buildings within it, can provide a much more varied picture of risk and resilience.

Sufficiently complex, well resourced, and granular climate risk modelling is essential – and current available datasets need to be considered in light of their limitations.

Physical risk analyses alone also do not account for the range of wider socio-economic factors that may improve or impede a city’s resilience to physical risk. How a city has already, or plans to, develop resilient infrastructure must be accounted for. Figure 5 compares the risk from extreme weather (the same data in Figure 4) with the preparedness of 59 major cities in developed economies. The preparedness score is based on a ranking of city infrastructure and environmental policies developed by Arcadis’ ‘Sustainable Cities Index’.

Physical climate-risk in financial modelling and decision making

Although research on the impact of climate on financial modelling and valuation of commercial real estate (CRE) is limited, it is supported by evidence within the residential sector which is expected to be realised in CRE in the coming years. However, the range of factors and inconsistencies observed in real asset valuations as a result of existing or potential climate-related risks and impacts, which will pose a significant challenge to the sector in the coming decade.

Secondary financial and social impacts

There are numerous secondary impacts associated with the physical climate risks in cities, specific asset classes and buildings. These would include consequences as wide as lost business operations during repairs, reduction in food production, declines in social wellbeing, social unrest etc. Furthermore as buildings are increasingly designed to reduce air permeability, with improved glazing and insulation in order to meet net zero carbon objectives, investors may find these assets are now not designed to cope with increasing temperatures as they cannot ventilate effectively!

Investment decision-making

It is clear that a paradigm shift is needed in how we approach physical climate risk analysis, and how the real estate sector incorporates this into financial decision-making. The complexity of interconnected risks and opportunities in global cities will require insurers to re-evaluate premiums in risk-prone or resilient areas. It will require valuers to determine robust and standardised protocols for evaluating resilient buildings and cities., Asset owners will need to develop intricate and complex modelling and assessment tools to critically assess assets at all lifecycle stages to ensure physical and financial resilience.

To achieve this, a number of advancements across the sector will be necessary:

- Better, more complex tools and modelling techniques to overlay micro-economic trends, social needs and potential secondary impacts onto physical risks

- Focussed and considered engagement with insurers and valuation professionals to understand how the adaptation at building level and city level will impact asset values, financial business plans, and exit cap rates.

- Improved integration of associated energy & carbon impacts of future climatic scenarios into existing net zero strategies (i.e. increased cooling loads, ineffectual renewables on site, potential risk to energy demand capacity)

- Engagement with tenants and occupiers on perceived impact of potential risks and the ability for them to adapt to new practices/ expectations

- Focussed collaboration with local and regional public bodies involved in area-wide adaptation planning to understand potential exposure of, or opportunities for, assets and cities.

- Enhanced due diligence to require more climate risk analysis, and interplay between risk and adaptation measures – either existing or required – at both asset and area-level.

- Greater understanding of connectivity and reliance upon infrastructure that may be at risk In the medium-term, insurance providers and valuation professionals may begin to account for future scenarios in their assumptions, resulting in decreased property values and potential stranding of maladapted or poorly located assets. In the short-term however, investors must begin to model expectations for increased premiums and reduced asset values in areas within, and in close proximity to, climate risks, and adapt their criteria for acquiring, managing and selling assets.

Further reading : Climate change and cities: Adapting real estate investment decisions, by Craig Morey, Climate Lead, Real Estate at Schroders.