Drawing on insights from DWS currency specialists, the analysis highlights how recent dollar softness fits into a shifting macro and policy landscape.

-

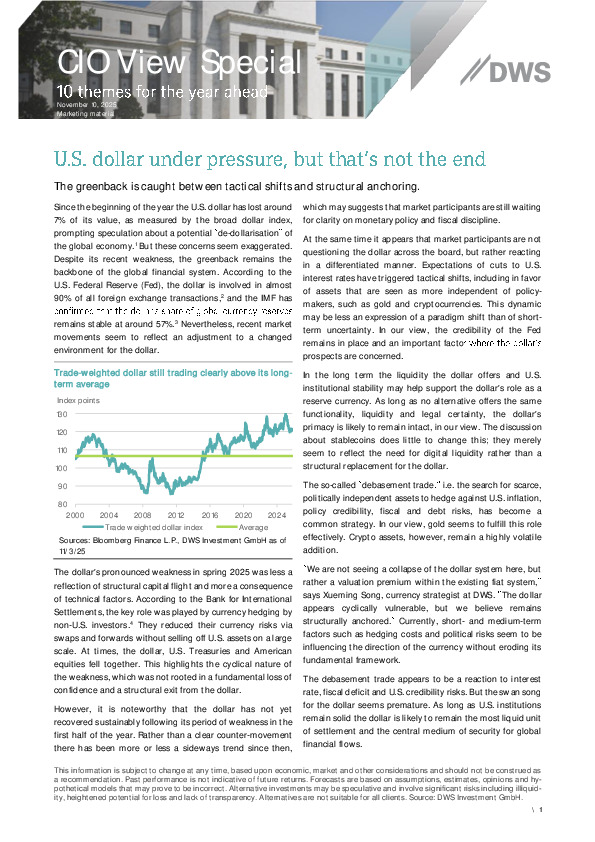

The dollar’s year-to-date decline stems largely from technical hedging flows rather than a fundamental reassessment of U.S. assets.

-

Liquidity depth and institutional stability continue to underpin its long-term reserve-currency role despite short-term policy uncertainty.

-

Tactical rotations into assets seen as policy-independent—such as gold—signal hedging behavior, not a structural move away from the greenback.

For a deeper exploration of the forces shaping the dollar’s outlook and the implications for positioning, the full report offers more detail.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.