2021 is poised to be the year of vaccines and a more durable, comprehensive economic reopening. While these developments will likely be positive for risk assets, the medium-term outlook for generating reliable, meaningful yield has never been more challenging, writes Evan Brown, Head of Macro Asset Allocation Strategy at UBS Asset Management in his paper ‘The road back to normal’.

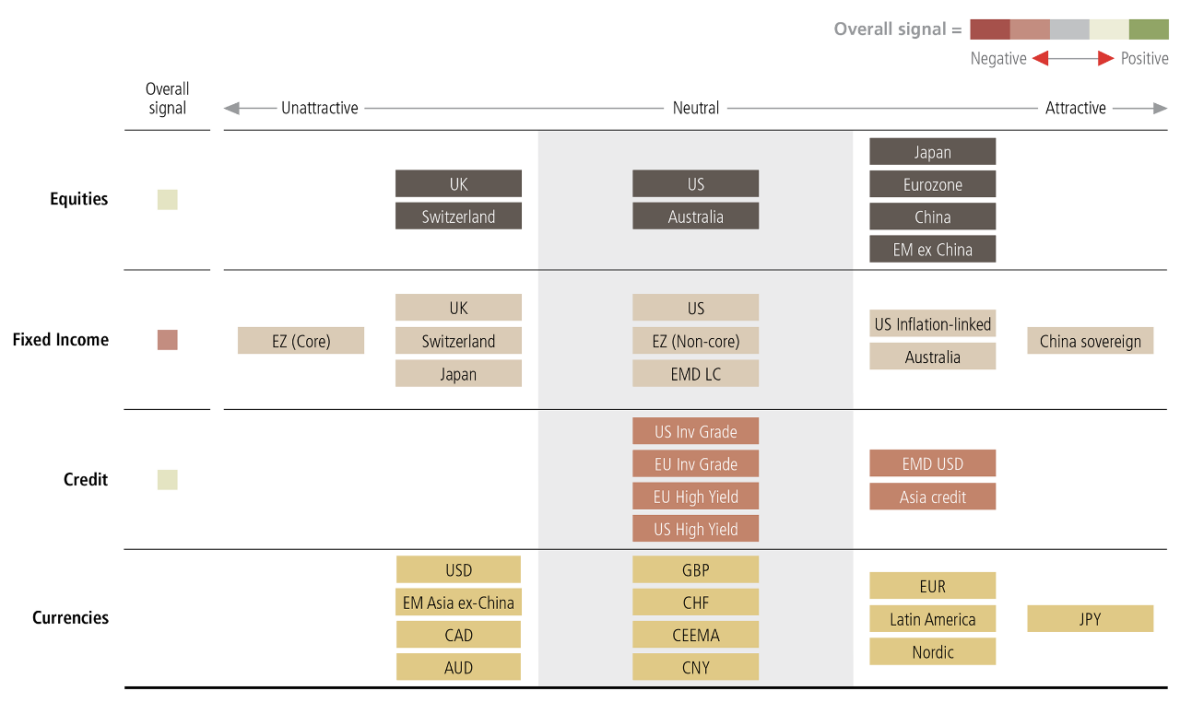

According to Brown, the appeal of opportunities in multi-asset hedge funds and alternative assets could increase in this low-yield-for-longer environment. “Within the publicly traded universe, the progression of the global economic expansion coupled with the low level of yields on developed-market sovereign debt should likely push investors up the risk spectrum. This makes emerging market dollar-denominated debt, including Chinese government bonds, particularly compelling.”

catch-up potential

Because of the outlook for a softer US dollar, the across-the-board outperformance of emerging market assets is our highest conviction view, which is bolstered by the election results, says Brown. “Beyond the aforementioned attractiveness of dollar-denominated debt in light of current spreads, we also favor emerging market currencies, which have outsized catch-up potential relative to other procyclical trades.”

In Europe COVID-19 that has caused disruption to the near-term growth outlook, but this has already been largely priced in, says Brown. “Going forward, we believe Ireland is a good leading indicator of the improvements in the virus outlook we expect across the continent. New case growth is declining, the lagged effect of government restrictions on activity that were enacted before other European countries.”

European cohesion

“We prefer non-US developed market equities, which have more cyclical exposure. This view is in part informed by the sea change in European counter- cyclical policy relative to a decade ago. The common shock spurred higher cohesion between European Union member states, reducing the prospect of premature fiscal and monetary tightening that suppressed the recovery from the global financial crisis, and in turn, political tail risks.”

Here you'll find the full 2021 Outlook 'Panorama' from UBS Asset Management.