An MFS Market Insights note features Brad Mak, Growth Portfolio Manager, outlining how the AI build-out is reshaping growth investing across sectors and time horizons.

-

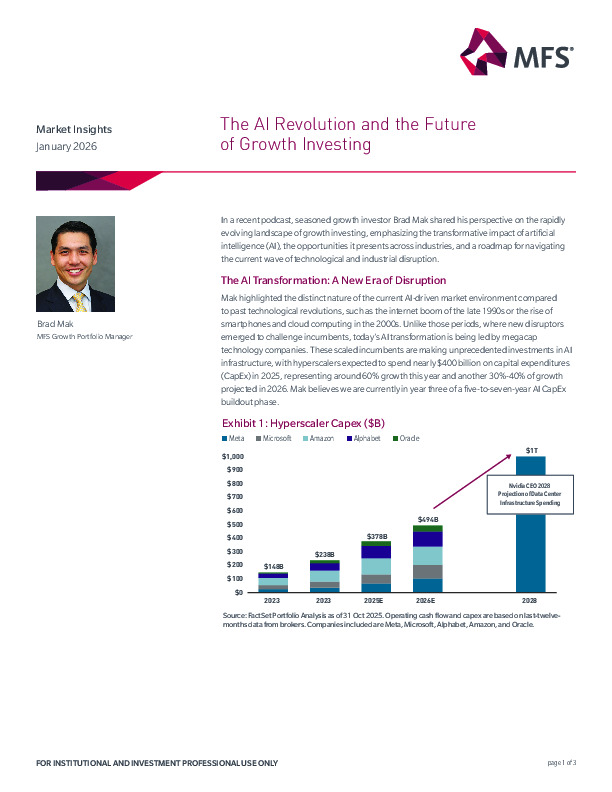

Hyperscalers are driving the cycle, with AI CapEx nearing $400bn in 2025 and a 5–7 year build-out still in its early stages.

-

AI’s spillovers extend beyond technology, lifting growth prospects in energy, capital goods, healthcare and industrial automation.

-

Valuations remain below prior tech-bubble peaks; risks centre on cycle duration, overcapacity and demand—but leverage in data-centre financing is still limited.

Explore the full insight for sector-level opportunities, adoption dynamics and risk frameworks shaping long-term growth portfolios.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.