BlackRock Investment Institute’s Weekly Commentary (Oct 6, 2025) assesses how a softer U.S. labor market and delayed data are shaping the Fed’s policy path and investor positioning.

-

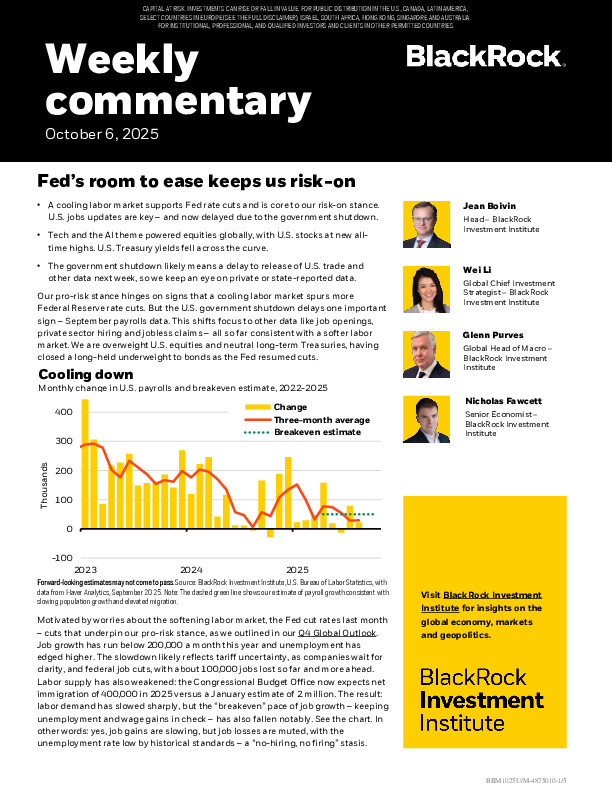

A cooling labor market supports further Fed rate cuts, reinforcing BlackRock’s overweight in U.S. equities and the AI-driven growth theme.

-

Despite the government shutdown delaying payroll data, alternative indicators—like jobless claims and private-sector reports—confirm a gradual slowdown without recession risk.

-

Long-term yields remain attractive, and investors are finding new alpha sources through FX hedging and selective infrastructure and private credit exposure.

Will the Fed’s cautious easing sustain market optimism—or expose new vulnerabilities? Read the full commentary for detailed insights.