Luxembourg is hoping its long, friendly relationship with China can help keep the superpower on a path towards more investment-friendliness instead of sable-rattling with the US. Levels of investment in China by Luxembourg-domiciled investment funds dipped during that country's difficult Covid times. Some institutional investors are staying away due to darkening US-China relations. Hopes for a resurgence depend on peace.

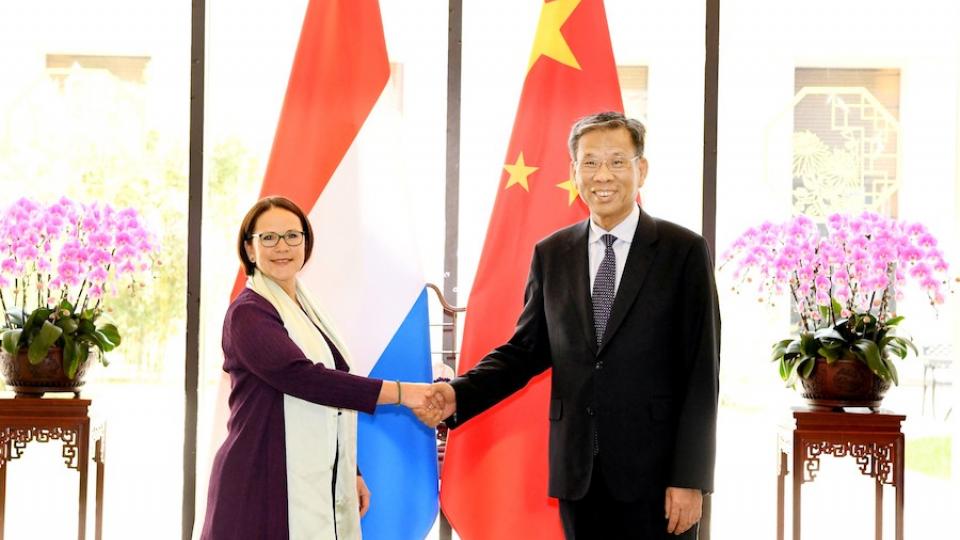

After a recent delegation to China in which Luxembourg finance minister Yuriko Backes met with her opposite number in China, Minister Liu Kun and several other figures of significance to Luxembourg, she summed it up:

"These fruitful dialogues with our Chinese partners not only underscore the strength of our bilateral relations but also our mutual commitment to further embedding sustainable finance and creating a more resilient global economy."

The dialogues, according to a finance ministry press release, included a meeting with Yi Huiman, President of the China Securities Regulatory Commission (CSRC), where they discussed the opening and internationalisation of the Chinese capital markets, as well as asset management.

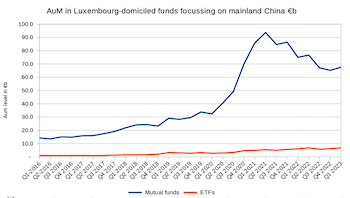

“I think the core of our relationship is actually the fact that Luxembourg investment funds are leading the world in channelling capital from global investors into Chinese A-shares and bonds,” said Nicolas Mackel, the CEO of Luxembourg for Finance, a public-private partnership between the Luxembourg government and the Luxembourg financial industry federation known by the acronym PROFIL. (See chart at right showing AuM in Luxembourg-domiciled funds focussing on mainland China from 2016-2023, based on LfF data.)

channelling capital from global investors into Chinese A-shares and bonds,” said Nicolas Mackel, the CEO of Luxembourg for Finance, a public-private partnership between the Luxembourg government and the Luxembourg financial industry federation known by the acronym PROFIL. (See chart at right showing AuM in Luxembourg-domiciled funds focussing on mainland China from 2016-2023, based on LfF data.)

For instance, he noted, Luxembourg leads the world in offering investments in so-called ‘dim-sum bonds’. “Obviously, that relationship is always contingent on what is happening around us.”

But in parallel, he said, “There’s not only the macroeconomic reality but there is also the geopolitical reality”, which he noted “is taking a turn”. He referenced the 'weather balloon story' from earlier this year.

Chinese People's Bank of China

Mackel pointed to “factory closures in China, not being able to visit, drop of demand, etc.” associated with “pandemic macro-economic turbulence", noting that since then “China has reopened and we’ll see where its growth rate will end up being this year.” He pointed out that many analysts are expecting that “if and when China’s economy starts roaring again, investors will go back into Chinese assets.”

Minister Backes also met with Yi Gang, Governor of the People's Bank of China (PBoC) to discuss the economic situation and its likely outcome in both countries. They also discussed developments in sustainable finance regulation and “welcomed the common ground taxonomy” between China and the EU. They emphasised the need to continue efforts to converge standards at the internal level.

In both Beijing and Shanghai, finance minister Backes met with the leaders of major Chinese financial institutions active in Luxembourg. After discussions about the companies’ activities in Europe and China, they discussed the macroeconomic situation in the two countries and “key geopolitical issues”.

The minister also attended a signing ceremony for a Memorandum of Understanding between the Luxembourg Stock Exchange and the China Everbright Bank, “aimed at promoting the integration of financial markets between Europe and China."

Shows of force

However, recent close encounters between American and Chinese combat aircraft and ships, including allegations of spying efforts, seem to complicate that noble goal.

“The rise in the heat and rhetoric between the US and China, that is not conducive to doing business.” He noted that many investors don’t want to find themselves on the receiving end of “US politicians’ wrath”.

Saying that this mostly affects local pension funds in the US, he pointed out that “you also hear the likes of Jamie Dimon and others who are not as outspoken as he is that they are in China for the long term and that they will ride this out,” he stated. “Obviously, as long as things don’t turn nasty."

Related articles on Investment Officer Luxembourg:

- China could be climbing out of the rabbit hole

- Luxembourg bourse open for trading in Chinese A-shares

- Morningstar Top 5: Robeco leads China A-shares funds