Alex Veroude, Global Head of Fixed Income, explains why the credit cycle in fixed income still has further to run in 2026, but investors should build some resilience into their portfolios.

Nature abhors a vacuum. Shorn of official US economic data in late 2025, markets began to speculate, with some high-profile bankruptcies and a torrent of AI-related debt issuance unsettling markets. But we should not confuse idiosyncratic issues at a few companies and shifting supply dynamics as spelling the end of the credit cycle. The economic picture looks broadly supportive for fixed income in 2026 but will demand vigilance. As such, we believe investors should look to build some resilience into their portfolios.

Liberation Day to Independence Day

One thing is for certain: If the US dominated headlines in 2025, things are not likely to change in 2026. The US will celebrate 250 years since its foundation as an independent country, so expect a party – perhaps the biggest you’ve ever seen. Whether the year’s festivities translate into stronger economic growth is debatable, but there are plenty of factors that should support economic activity in 2026. Consumers and companies will benefit from tax cuts enacted in the One Big Beautiful Bill Act; de-regulation has the potential to alleviate corporate roadblocks and encourage M&A; and monetary policy in the US is likely to see further interest rate cuts.

On the negative side of the ledger, the distorting impacts on data following the government shutdown may be a source of volatility in the near term, particularly in relation to jobs. Additionally, while we are arguably past peak tariff volatility – unless the Supreme Court throws them out – we still need to be watchful for any second-order effects on inflation.

Central bank policy supportive, but credibility is key

Rate cuts in the US should be broadly supportive for fixed income. But markets may be paying closer attention to the “why” rather than the “what” around rate decisions.

Jerome Powell’s term as Chair of the US Federal Reserve (Fed) ends in 2026. The White House favours the next Chair to be “Team Trump”, implying accommodative monetary policy. Whoever is appointed to the role will help shape not just US monetary policy but the risk-regime of markets globally. Expect greater scrutiny over whether cuts are justified (responding to weakness in economic growth or employment) or seen as pro-cyclical (easing despite strong growth or above-target inflation). Regardless, we expect cuts to pull down the front end of the yield curve. The outlook further along the curve is more ambiguous, causing us to generally favour shorter-dated securities, with duration (rate sensitivity) played more tactically across the year.

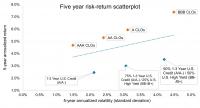

Fixed income in 2026 will be driven by AI-driven debt, tight spreads, resilient fundamentals, and opportunities in securitised and private credit for income and diversification.