This commentary highlights the implications of unusually tight high-yield spreads for forward returns.

-

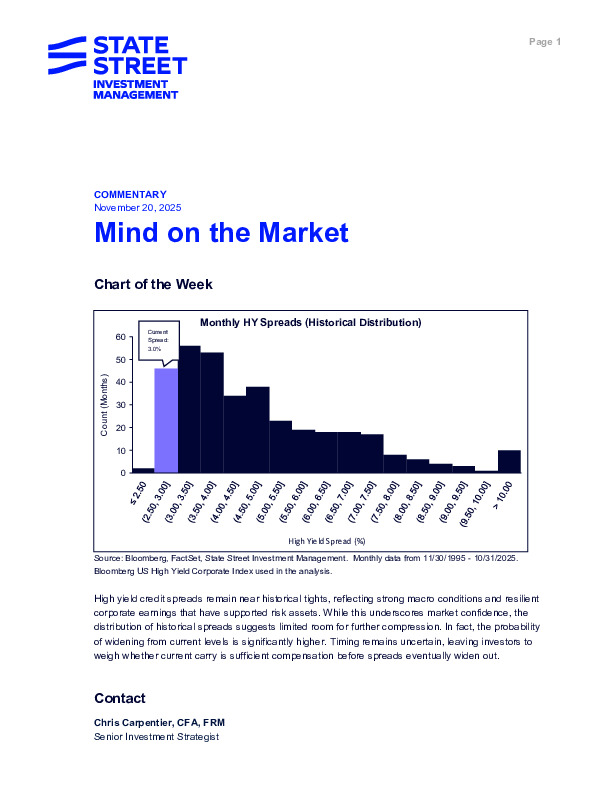

High-yield spreads sit near historical lows at roughly 3%, offering steady carry but leaving little room for further compression and increasing the probability of widening.

-

Historical periods with sub-3% spreads delivered modest one-month gains for HY, while equities showed a wider dispersion of outcomes and notably stronger upside potential.

-

With 2026 expected to bring above-trend growth, equities may offer more attractive risk-reward than credit, though HY remains valuable for income and diversification.

Review the full commentary to assess how tight-spread environments should influence portfolio positioning.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.