Written by Guido Giammattei, this briefing weighs the transformative potential of AI against growing signs of overheating.

-

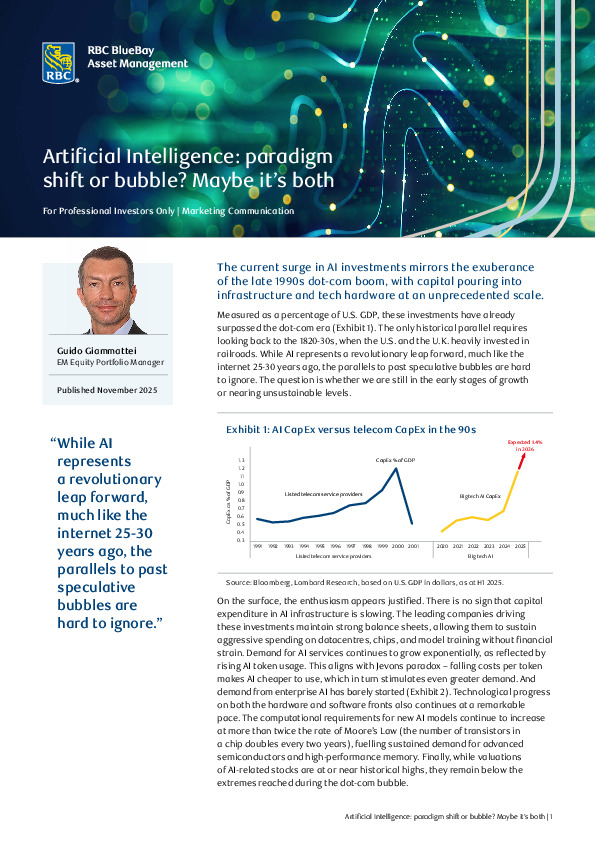

AI infrastructure spending has surpassed the dot-com era, powered by strong balance sheets and accelerating demand, yet accompanied by rising leverage, complex financing structures, and increasing competition.

-

Monetisation remains uncertain: revenues are nascent relative to massive CapEx, depreciation may be underestimated, and profitability timelines are long.

-

Energy and infrastructure constraints are emerging as material bottlenecks, with U.S. power shortages projected if current data-centre expansion continues.

Explore the full analysis to assess where genuine long-term value may lie within this rapidly evolving theme.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.