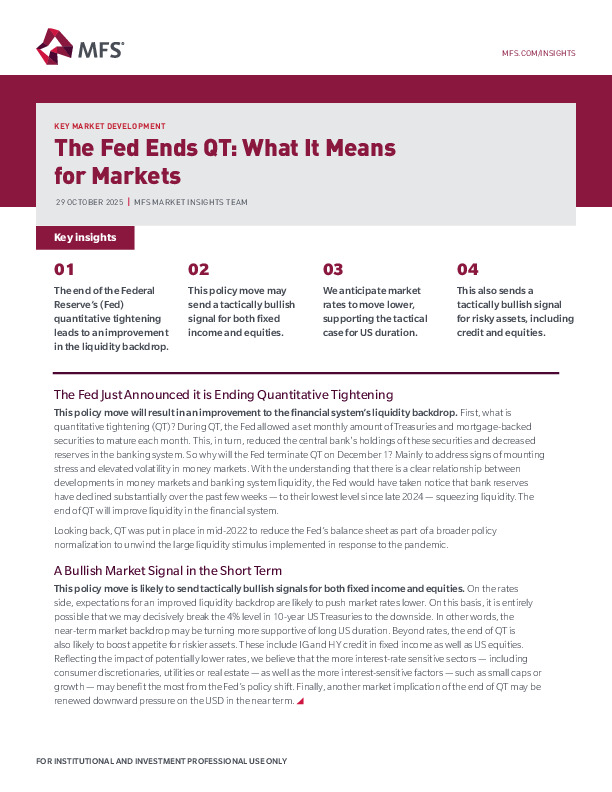

This report from the MFS Market Insights Team (October 29, 2025) examines the Federal Reserve’s decision to end Quantitative Tightening (QT) and its implications for markets and liquidity.

-

The Fed’s termination of QT on December 1 aims to ease mounting stress in money markets and improve banking system liquidity.

-

MFS expects lower market rates and a near-term bullish signal for both fixed income and equities, particularly rate-sensitive sectors.

-

Renewed downward pressure on the USD may accompany increased risk appetite for credit and equities.

Explore the full report for detailed analysis on positioning, sector impacts, and liquidity dynamics.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.