DWS’s CIO Special – Digital Assets (Oct 2025) highlights the growing institutional role of regulated stablecoins in global finance.

-

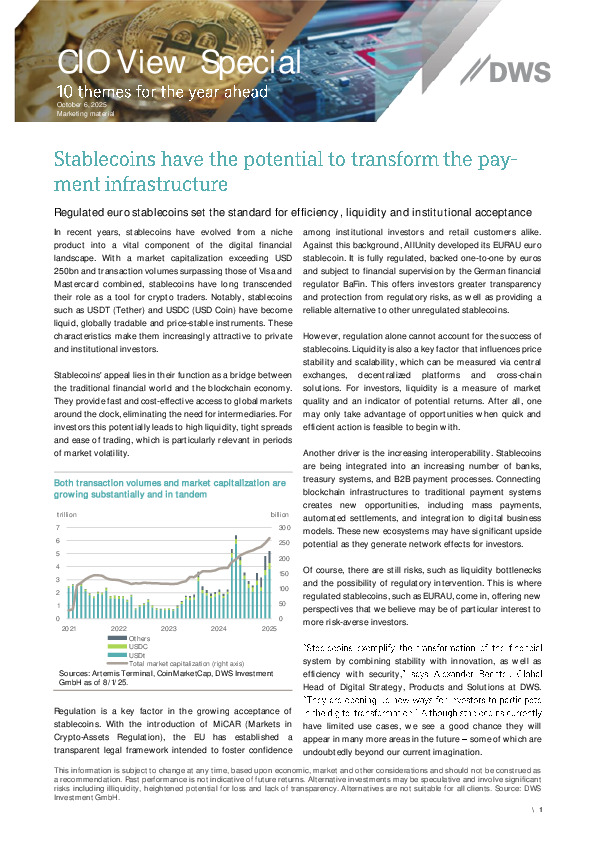

With USD 250bn+ in market cap and transaction volumes exceeding Visa and Mastercard, stablecoins have evolved into core settlement infrastructure for digital finance.

-

The EU’s MiCAR regulation is accelerating institutional adoption, enabling fully supervised instruments like AllUnity’s EURAU euro stablecoin, backed 1:1 and regulated by BaFin.

-

Liquidity, interoperability and integration with banking, treasury and B2B payment systems are driving new use cases—from automated settlements to cross-chain finance.

Are regulated stablecoins becoming the backbone of Europe’s digital financial architecture? Explore the full report for strategic implications.