In its July 2025 Market Perspectives, Vanguard’s Investment Strategy Group evaluates global asset class expectations amid a weaker U.S. dollar, evolving rate policy, and rising equity valuations.

-

The U.S. dollar's 8% decline YTD has boosted USD-denominated international returns, particularly in European and emerging market equities.

-

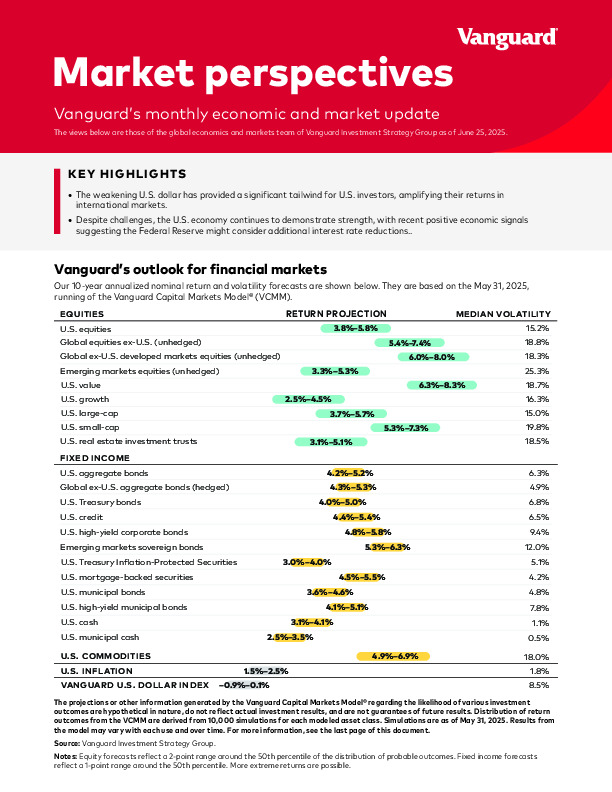

Vanguard forecasts subdued long-term equity returns, with the U.S. equity risk premium nearing zero—implying limited compensation versus bonds.

-

Two Fed rate cuts remain likely in 2025 as inflation moderates and tariff tensions ease, with policy nuance critical for forward guidance.

Which global exposures still offer attractive relative value? Read the full report for Vanguard’s 10-year capital market assumptions.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.