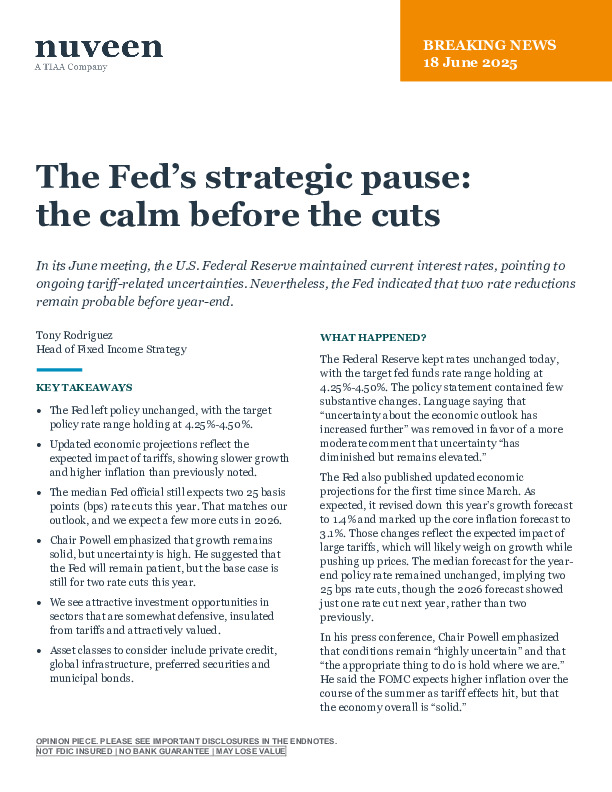

In this June 2025 outlook, Nuveen’s Tony Rodriguez analyzes the Federal Reserve’s policy pause and the implications of inflation, tariffs, and economic uncertainty for investors.

-

The Fed held rates at 4.25%–4.50% but signaled two cuts likely in 2025 amid tariff-driven inflation and slowing growth.

-

Private credit and infrastructure emerge as attractive asset classes, offering resilience in a mixed macro environment with elevated fiscal and policy risks.

-

Preferred securities and municipal bonds may deliver income and capital gains, supported by robust fundamentals and elevated yields.

Explore the full report for actionable insights on portfolio positioning ahead of a shifting rate environment and widening policy scenarios.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.