GMO’s July 2025 Asset Allocation update revisits the case for value investing, highlighting the historically extreme discounts now seen in both U.S. and international markets.

-

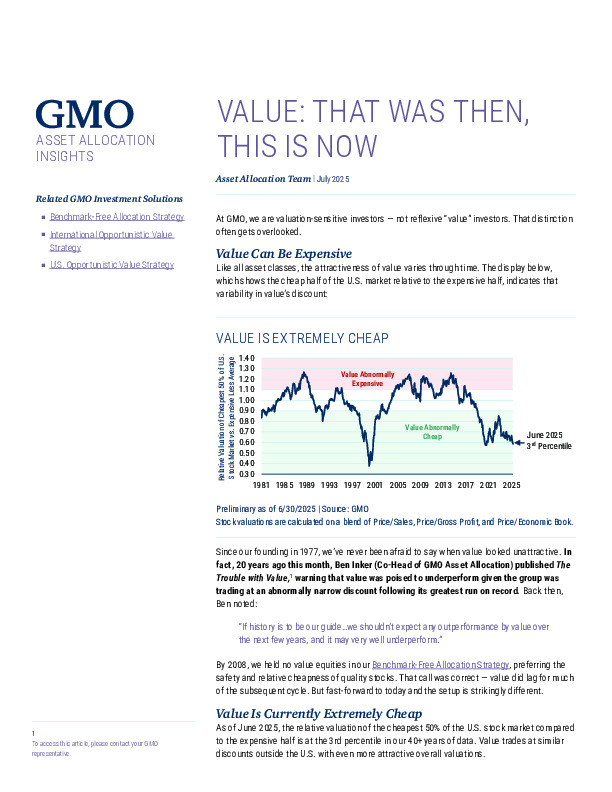

Valuation dislocation: The cheapest half of U.S. equities trades at the 3rd percentile relative to expensive stocks in over 40 years of data, signaling deep value appeal.

-

Selective implementation: GMO favors the bottom 20% of stocks by valuation, which offer both cheaper pricing and better fundamentals than broad value indices.

-

Discipline over labels: Past cycles inform today’s positioning—value isn't always attractive, but current market conditions call for valuation-based exposure.

Is your portfolio aligned to capture one of the strongest deep value signals in decades? The full report details GMO’s allocation shifts and strategic conviction.