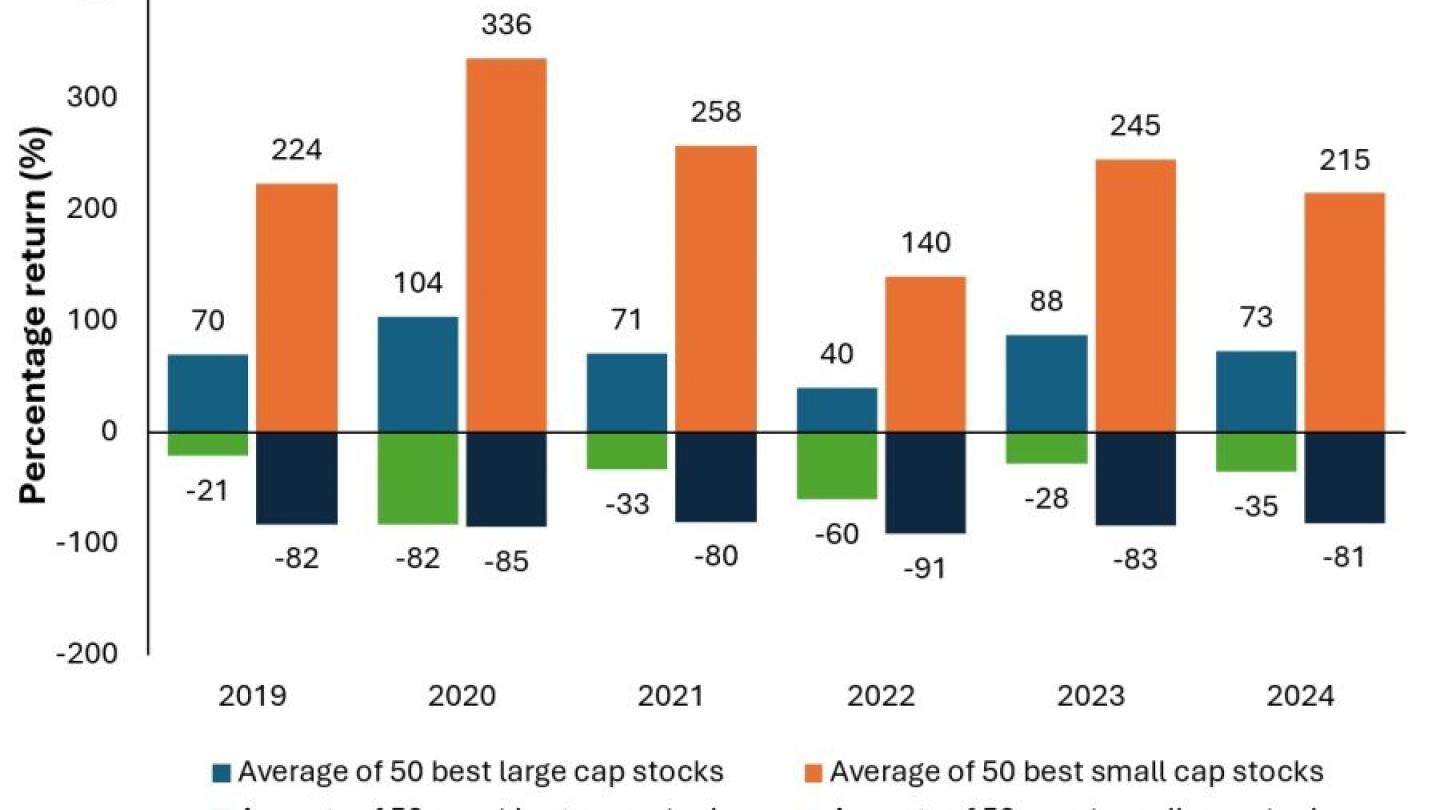

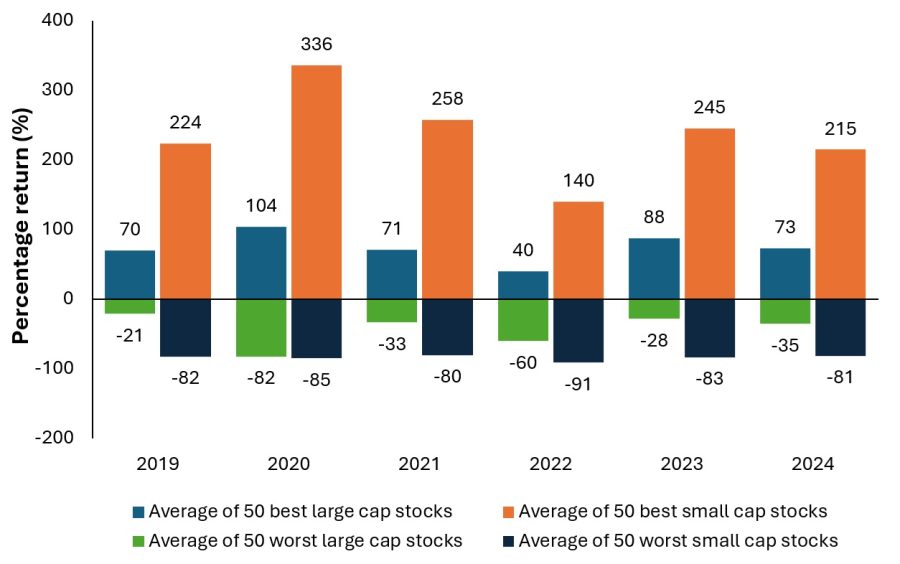

While big tech is making headlines in the US, small caps benefit from much high pricing dispersion and market inefficiencies. Is this the area where active managers can shine?

Source: Morgan Stanley, Janus Henderson Investors as at 30 September 2025.

While big tech is making headlines in the US, small caps benefit from much high pricing dispersion and market inefficiencies. Is this the area where active managers can shine?

The Magnificent 7 (MAG7), US tech stocks – Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla – continue to dominate large-cap indices, driving much of recent market returns, and now accounting for a huge share of the S&P500 Index. This has left passive portfolios, especially market-weighted index funds, highly exposed to the fortunes of just a few companies. But what is notable is that beyond these mega-cap names is another group of stocks that can deliver higher growth at lower valuations.

To find out how small-cap investing offers distinctly asymmetrical potential for returns, read the full article here.