Fresh signals from BlackRock’s weekly commentary show how the end of the U.S. government shutdown revives crucial macro visibility.

-

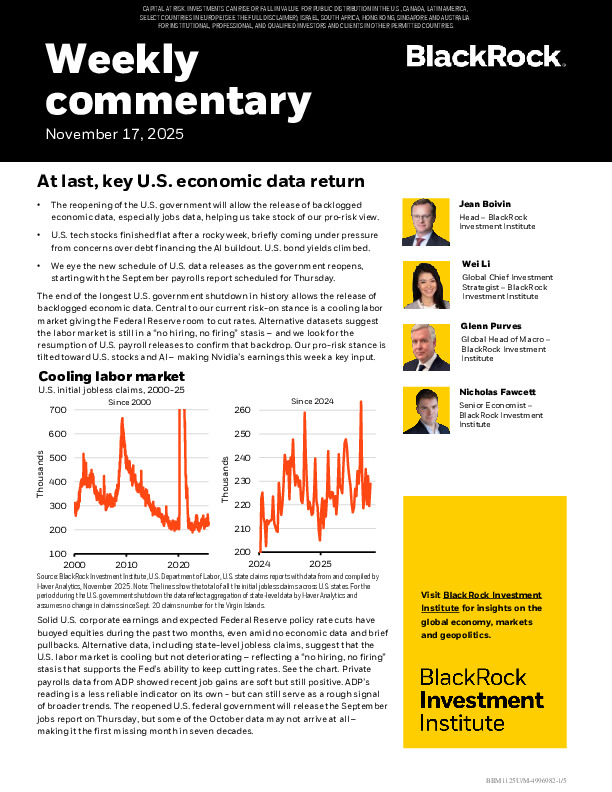

Backlogged labour data should soon confirm whether the “no hiring, no firing” equilibrium persists, a backdrop that supports the Fed’s path to further rate cuts and underpins a pro-risk stance.

-

AI-related equities remain central to market leadership, with mega-caps expanding capex and issuing debt to fund the buildout—strengthening earnings breadth beyond the largest names.

-

European earnings continue to lag U.S. momentum, keeping regional exposure neutral despite isolated opportunities in financials and sectors tied to defence and infrastructure.

If you want a clearer picture of how the return of official data could shift market positioning in the weeks ahead, the full commentary offers deeper guidance.