Markets often reward what is loud and immediate. But the forces that shape long-term returns usually build quietly in the background. In Japanese small-caps some changes may not be making headlines, but are reshaping the opportunity set for patient investors.

Governance reform is gathering pace in Japan

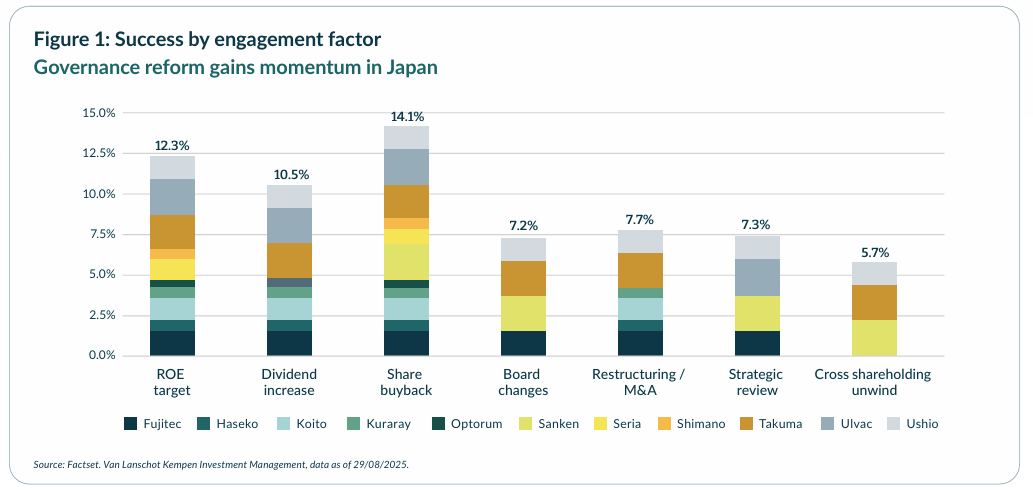

Corporate governance in Japan has been evolving for years, but the pace of change is accelerating. Engagement is delivering tangible results. We observe companies introducing share buybacks, setting clearer return targets and refreshing boards. As illustrated in Figure 1, these actions reflect a cultural and regulatory push towards better capital discipline and more shareholder-aware decision-making. Recent policy shifts in Japan reflect a broader move towards more active capital discipline, reinforcing the momentum behind governance reform.

These changes lay the foundation for sustainable value creation. Better governance improves how cash is deployed, which can raise the quality and resilience of future cash flows. For long-term investors, this is the kind of change that compounds over time. Japan’s progress also matters globally because it signals that shareholder engagement can unlock value in markets where governance reform was once considered slow-moving.

Disclaimer

Van Lanschot Kempen Investment Management NV (‘VLK Investment Management’) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, investment recommendation, research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of the date of publication only. These may be subject to change at any time, without prior notice.

Small-cap equities: general risks to take into account when investing in small-cap equity strategies.

Please note that all investments are subject to market fluctuations. Investing in a small-cap equity strategy may be subject to country risk and equity market risks, which could negatively affect performance. Under unusual market conditions, these specific risks can increase significantly. Potential investors should be aware that changes in the actual and perceived fundamentals of a company may result in changes to the market value of the shares of such company. Equities of companies with small capitalisation can be more volatile than equities of mid and large companies and may also be less liquid. The value of your investment may fluctuate. Past performance is no guarantee of future results. Do not take unnecessary risks. Before you invest, it is important that you are aware of and are informed about the characteristics and risks of investing. This information can be found in the available documents of the strategy and/or in the agreements that are part of the service you choose or have chosen.