Portfolio Manager Ian Bettney highlights how regulatory alignment and global issuance trends are unlocking new opportunities for European securitised investors, enabling them to globalise portfolios, capture relative value and strengthen resilience as we head into 2026.

The securitised credit market enters 2026 with a clear theme: a growing and broadening opportunity set for European investors, driven by regulatory alignment and global issuance trends. This evolution is creating scope to globalise portfolios, capture relative value and access new opportunities in primary markets, amid a volatile macro backdrop.

Globalisation of portfolios: regulatory alignment unlocks scale

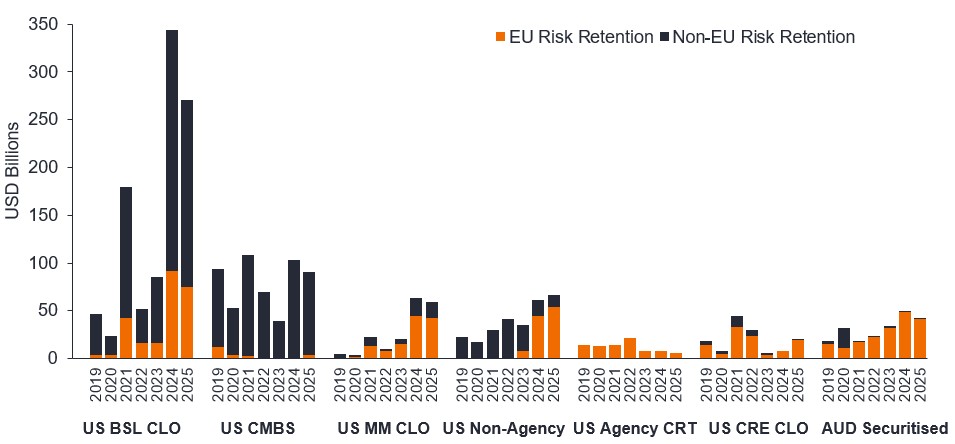

One of the most significant developments is the rise in EU-compliant securitised issuance from non-European jurisdictions. The ability of European-based investors to create truly globally diversified securitised portfolios was greatly diminished following the implementation of the European Securitisation Regulation in 2019. However, global securitisation issuers are recognising more the benefits that structuring their deals to meet European requirements can bring by expanding the breadth and depth of their investor base.

Figure 1: A number of sectors showing higher eligible issuance

Source: Janus Henderson Investors as at, 30 September 2025.

Source: Janus Henderson Investors as at, 30 September 2025.

Note: Not all US issuance that is EU/UK risk retention eligible is fully EU/ UK Securitisation Regulation compliant as other articles of the regulation may not be met. BSL CLO: Broadly Syndicated Collateralised Loan Obligations; CMBS: Commercial Mortgage-backed Securities; MM CLO: Middle-market Collateralised Loan Obligations; CRT: Credit Risk Transfers; CRE CLO: Commercial Real Estate CLO; AUD Securitised: Australian securitised.

One jurisdiction that has reaped the benefits of this is Australia, a large securitisation market relative to the size of its economy with less restrictive regulations than Europe. Despite this, most of their issuers choose to comply to European regulations and the jurisdiction has benefitted from continued growth and, this year in particular, from significant spread compression. After setting a post Global Financial Crisis (GFC) issuance record last year, Australian securitised markets recorded another strong year of issuance in 2025[1]. This is a space we have long been active in with our global platform having dedicated local resource and longstanding relationships with issuers. In fact, this is a sector in which we significantly invested in recent years while our competitors either had no allocation or were only just starting to. We still have a constructive view albeit less so given the rapid spread compression experienced throughout 2025.