Gold companies as a source of opportunity

The gold market has risen sharply since the start of 2025, driven by favorable economic and political risks (inflation, geopolitical uncertainty, Trump’s return to power, massive central bank and investor buying, etc.)

- Investing in gold companies can be complementary to owning gold and sometimes more beneficial. These companies benefit not only from the rising gold price, but also from solid fundamentals, positive cash flow, attractive valuations

WHAT’S THE OUTLOOK FOR GOLD IN 2025?

In 2025, gold continued its 2024 rally, driven by economic and political risks (trade wars, US inflation, political instability, etc.). This was heightened by Trump’s return to the US presidency, his new administration, and his first decrees, which only increased uncertainty. All these factors convinced investors to return to this theme and, in February, gold posted a new record high of $2956.2 per ounce (24 February 2025). Demand from Western investors is growing, whether through Gold ETFs, but also through physical gold deliveries. In addition to the People’s Bank of China’s purchases, some insurance companies have recently launched a pilot program, allowing them to invest in gold as part of their medium to longer term asset allocation strategies. All the lights are green, and this should support gold demand. The silver market is up 12.8% year to date to US $32.6 per ounce.

The current environment remains very favorable for precious metals producers. Indeed, the recent good production and financial results of 2024, as well as the continued rise in metal prices and good control of production costs, boost investor confidence in 2025. This is especially so given the belief that gold prices will remain elevated this year.

The gold industry has performed well above gold in this new year: +22.3% for the Nyse Arca Gold Miners index against +10.8% for the ounce of gold (07/03/2025 in USD). This can be explained by (I) the quality of operational results issued by companies, (II) good metal prices (III) a delay in the valuation of companies at this level of gold prices.

Today, investors are looking for the leverage offered by companies in anticipation of a further rise in the price of gold, and significant investment flows are once again entering the sector. In addition, companies have provided their ‘guidances’ for 2025, and with such a high metal price, analysts are likely to have to revise their estimates upwards, another support factor for the sector. All of this is not yet factored into company valuations.

WHY INVEST IN GOLD COMPANIES RATHER THAN PHYSICAL GOLD?

Gold is often seen as a counter cyclical asset, popular in times of economic weakness or market volatility. While it can provide protection against inflation and improve the risk/return ratio over the long term, investing in gold companies may be additional to physical gold or gold ETFs.

These companies (gold companies) are supported by solid fundamentals and a positive market momentum. They are a direct beneficiary of higher gold prices, with production costs under control, high and rising margins and positive cash flow generation. In addition, these companies have strong balance sheets with a focus on returning value to shareholders through dividends.

Although the rise in the price of gold has led to an increase in their valuations, these companies are still considered relatively cheap when considering future earnings expectations. The market has yet to fully recognize the sustainability of the current gold price rally which means gold mining companies could post better than expected earnings.

In addition, the industry has become more consolidated, with large firms buying smaller, undervalued businesses, which has the potential to grow.

To sum up, investing in gold companies offers the benefit of a combination of rising gold prices and company specific operating strengths such as strong cashflows, cost effective management and shareholder-oriented strategies. This combination of factors can generate attractive yields beyond the simple move in the price of gold.

FOCUS ON CM-AM GLOBAL GOLD, OUR SOLUTION FOR EXPOSURE TO THE GOLD MARKET

With nearly 20 years of expertise in gold, CM AM Global Gold, a conviction-based fund, may be considered an attractive way to gain exposure to the gold theme.

This global equity fund, which invests primarily in precious metal miners, has no country or currency hedging constraints and does not invest directly in physical gold. It provides a diversification solution, thanks to its low correlation to traditional asset classes, while maintaining a high exposure to physical gold ¹.

The fund is mainly invested in gold mining companies ‘Majors’ and ‘intermediates.’ The former are companies with a market capitalisation of more than 8 billion USD, with production exceeding 1 million ounces, while the latter have a market capitalisation between 2 and 8 billion USD and an annual production value between 250,000 and 1 million ounces. The fund’s production exposure is mainly concentrated in Latin America 33% ² and North America 31% ². The fund’s currency exposure, on the other hand, is primarily CAD (75% ² in CAD) ³, as most gold companies are Canadian.

Charlotte Peuron, Manager of the CM-AM Global Gold fund

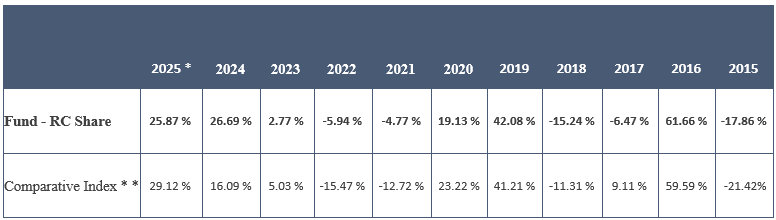

CM AM Global Gold adopts an investment process based on in depth fundamental company research. This qualitative approach assesses the quality of mining assets, management teams, the political context, the relative valuation of companies as well as extra financial criteria. Thanks to this process, the fund is rated 4 Morningstar stars ¹ and has a strong 10 year performance vs. its index.

CM AM Global Gold RC

NYSE Arca Gold Miners **

* Data as of 31 March 2025

Sources : Groupe La Française, SIX. Past performance is no guarantee of future performance.

* * As at 02/01/2023, the FTSE Gold Mines Index was replaced by the NYSE Arca Gold Miners.

¹ © 2025 Morningstar. All rights reserved. Data over 3 years as at 31/03/2025.

¹ The fund’s correlation with gold has been approximately 0.70 for 20 years.

² Data for the RC share at 31/01/2025. Past performance is no guarantee of future results.

³ Portfolio allocation is subject to change at any time. These data are provided for illustrative purposes only. Depending on the date of publication, the information presented may differ from the updated data.

Key Risks: risk of capital loss, risk related to discretionary management, equity market risk, risk related to investing in emerging markets, risk related to sustainability. Past performance is no guarantee of future performance.

This communication is intended for non-professional and professional investors as defined by MiFID 2 .

This product contains a number of risks described in the prospectus (available on the website https://www.la-francaise.com/fr/et can be communicated upon request), including: Risk of capital loss, risk related to discretionary management, equity market risk, risk related to investment in small capitalization shares, risk of investment in emerging markets.

The information contained in this document should not be construed as investment advice, an investment proposal or any inducement to operate in the financial markets. Opinions expressed reflect the opinion of the authors as of the date of publication and do not constitute a contractual commitment of the La Française Group. These assessments are subject to change without notice within the limits of the prospectus, which alone is authoritative. The La Française Group cannot be held liable in any way for any direct or indirect damage resulting from the use of this publication or the information contained therein. This publication may not be reproduced, wholly or in part, distributed or distributed to third parties, without the prior written authorization of Groupe La Française. www.la francaise.com

Communication edited by Le Groupe La Française, a société Anonyme with executive boards and supervisory board with capital of €78836320 - RCS PARIS 480,871,490.

Crédit Mutuel Asset Management: 128, boulevard Raspail 75006 Paris. Asset Management Company approved by the AMF under number GP 97,138. Société Anonyme with capital of euros3871680 registered in the Paris Trade and Companies Register under number 388,555,021 APE Code 6630Z. Intra Community VAT: FR 70 3 88 555 021. Crédit Mutuel Asset Management is a subsidiary of the La Française Group, the holding company for the management of assets of Crédit Mutuel Alliance Fédérale.

La Française Finance Services, an investment company authorised by the ACPR under no. 18673 (www.acpr.banque-france.fr) and registered with the ORIAS (www.orias.fr) under no. 13007808 on

4 November 2016.

Internet contact details of the supervisory authorities: Prudential Control and Resolution Authority (ACPR) www.acpr.banque-france.fr, Autorité des Marchés Financiers (AMF) www.amf-france.org