Serge Pizem, Global Head of Multi-Asset Investments

Due to a situation that is both unique and unpredictable, the markets have lost considerable ground since late February and remain volatile in the short term. In fact, March saw the MSCI All Country World Index fall over 2% in a single day on 12 March, its lowest intraday level since January 2019 – and 20% below its one-year peak return on 12 February. Elsewhere, the UK’s FTSE 100 Index saw its largest single-day drop on 12 March 2020 since the Black Monday crash in October 1987, falling 10.87%. Meanwhile, other European markets also suffered sharp falls, including -12% for shares in Germany and France, -14% in Spain and -17% in Italy – the heart of the outbreak in Europe. The US markets also reported record lows and levels of volatility that have not been seen since 2008 [1].

The crisis we are currently experiencing is unprecedented, and therefore a great deal of uncertainty remains around how the situation will develop and what the longer-term economic impact will be.

Keep calm and wait for the crisis to blow over

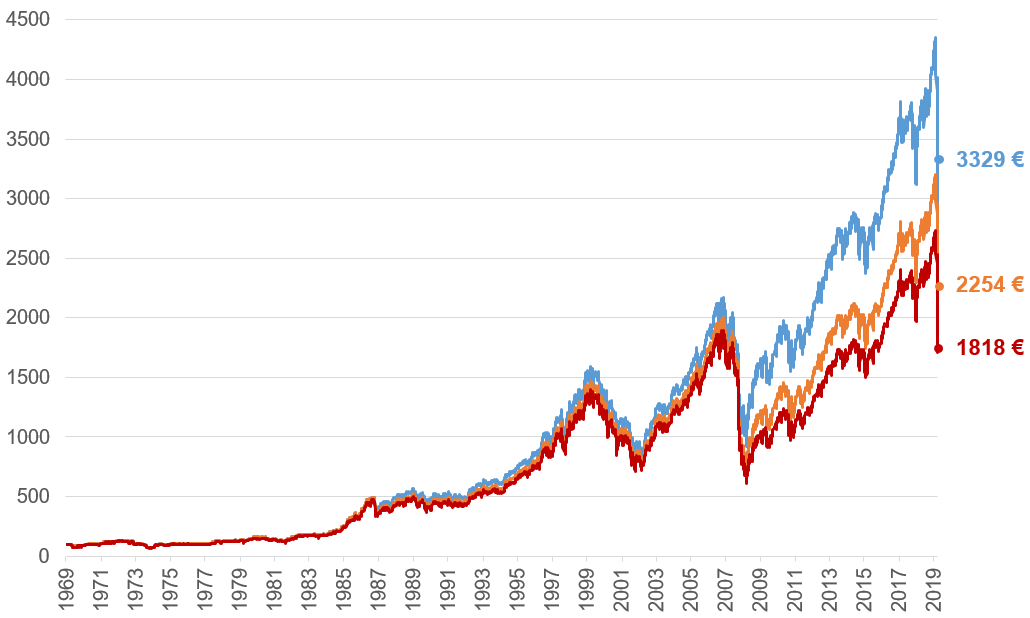

During times of significant uncertainty, our behaviour is influenced by a constant flow of anxiety-producing information. The negative sentiment this creates can be rattling and can cause us to act rashly. It can even trigger panic. In this context, the best solution is often to take a step back and let the storm pass, rather than try to move your money in and out of markets to mitigate downturns. Investors who have opted not to invest in stocks in the hope that the market will fall further, and those who sell now so they can buy later at a bigger discount, risk missing out on great opportunities. The following example illustrates the impact of missing out on the market's best days on a long-term investment:

- An investor who purchased €100 in international stocks (MSCI World Index) 50 years ago on 31 December 1969 would have seen this amount increase to €3,329 by the end of March 2020 (blue line), with an annualised return of 10.16%.

- However, if that same investor had missed out on the five days where stocks performed the best in the past five decades, the total value of their investment would fall by over €1,000 to €2,254 (orange line), with an annualised return of 9.92%.

- If the same investor missed out on the 10 days in which stocks performed the best during this time, the cumulative value of their investment after 50 years would be €1,818 (red line), with an annualised return of 8.24%.

Source: Bloomberg, from 31 December 1969 to 31 March 2020. MSCI World Index, reinvested dividends, in US dollars. Past performance is not a guide to future performance.

Stay invested

“A loss isn't a loss until you sell”. It's clear - missing out on the market's best days can significantly impact the end performance of an investment. Markets are constantly shifting - even more so during a crisis - which means that getting in and out of the market based on its fluctuations is a strategy that can have costly consequences. Given the risk of committing these types of errors, adopting a short-term approach, or trying to predict the market's movements, is not recommended. This is even more true when the context is as volatile as it is now.

By staying invested, you won't miss out on the market's recovery following a significant drop. The two examples below are a good illustration of this point.

Source: Thomson Reuters Datastream, AXA IM. Based on MSCI World index provided by Thomson Reuters Datastream on annual basis and assumes no charges. The index is in local currencies (no currency risk involved) and assumes all income reinvested. Past performance is not a reliable indicator of future performance.

A cost-averaging investment strategy could also prove worthwhile for investors. By investing regularly (for example, on a monthly basis), investors can build capital over the long term while smoothing out ‘market effects’ over time. Nevertheless, this approach does not entirely eliminate the risk of losing capital.

Think long term and diversify your portfolio

“Don’t put all your eggs in the same basket”. We believe the best way to cope with market volatility is to prepare for it through a well-diversified portfolio in which the money is invested in a variety of asset classes, including equities, fixed income and property. In different phases of the market, these asset classes don't always behave in the same way. As a result, diversification can reduce a portfolio's overall risk.

In the end, investing is first and foremost an activity that requires a long-term approach if you want to maximise your chances of increasing the capital you’ve invested.

For example, imagine you invest €1,000 every year at an average annual interest rate of 2.5%. If you start at the age of 25, you will have saved a total of €69,088 by the age of 65. If you start at the age of 35, you will have saved €45,000, or €24,000 less.

Source: AXA IM. For illustrative purposes only.

Should the most opportunistic investors reinvest?

The boldest investors who have a greater appetite for risk can choose to invest a portion of their savings to take advantage of the opportunities created by drastic market corrections. Some sectors and/or values have experienced more significant drops than others, and yet also have solid outlooks and business plans, which make them more promising entry points. The current period offers its share of opportunities, assuming the economy begins to improve in the near term.

The final word

At AXA IM, we will continue to monitor the situation closely. For both investors and asset managers, staying in the market, refusing to give into panic and maintaining a long-term vision seems to be the most sensible strategy - especially in these turbulent times. As asset managers, selecting and allocating to equities lies at the heart of our business. Despite the chaos in the markets, our job consists of actively and reactively managing asset allocations to take advantage of market opportunities, and identify attractive valuations and companies that offer the best options for weathering this crisis.