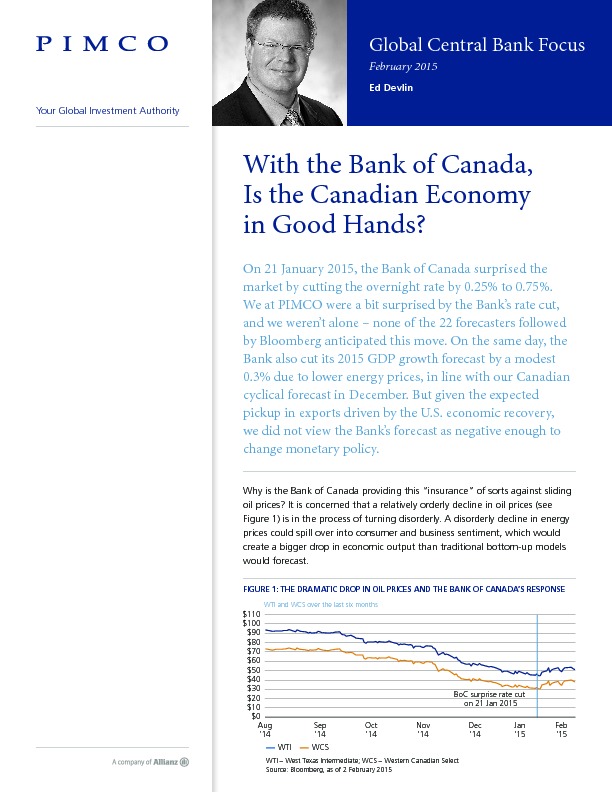

- A disorderly decline in energy prices could spill over into consumer and business sentiment, which would worsen any drop in Canada’s economic output.

- More rate cuts this year are likely a part of the Bank of Canada’s base case scenario.

- Investors may be able to improve their returns by buying bonds with high-quality credit spreads, including Canadian bank senior debt and Ontario bonds.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.