This weekly commentary assesses how a maturing U.S. easing cycle is reshaping asset allocation and reviving interest in tax-advantaged income.

-

Markets are shifting from rate-direction bets to duration and cash-flow discipline, with volatility easing and equity returns increasingly driven by earnings rather than liquidity.

-

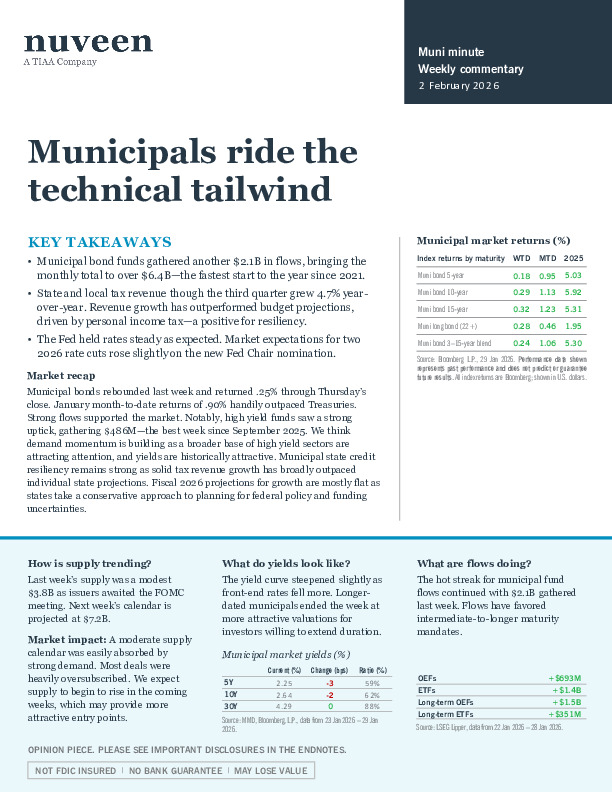

Municipal bonds are benefiting from strong technicals in early 2026, as heavy reinvestment flows outweigh elevated issuance and investor demand rebounds.

-

Credit fundamentals remain robust, with state and local balance sheets near multi-decade highs and municipals offering compelling taxable-equivalent yields versus corporates.

Is this the moment for munis to reclaim a strategic role in portfolios? The full commentary details the macro logic and portfolio implications.