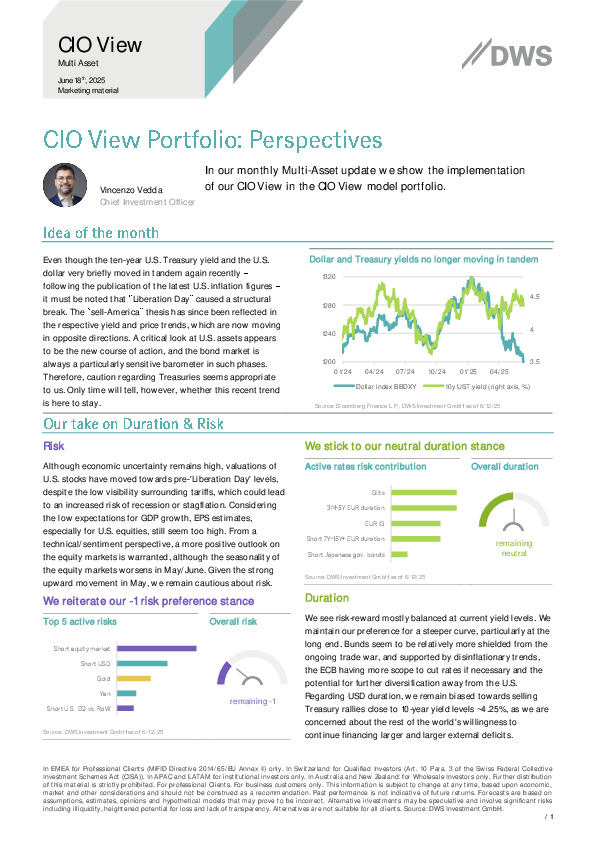

In its June 2025 Multi-Asset CIO View, DWS outlines how recent macro signals and geopolitical shifts are shaping portfolio allocations and risk assessments.

-

U.S. equities remain vulnerable to elevated valuations and tariff-related risks, prompting continued underweight and a tilt toward healthcare and minimum volatility strategies.

-

The firm maintains a neutral duration stance, preferring long-end steepeners and expressing caution on U.S. Treasuries due to external financing concerns.

-

EUR investment-grade credit is favored over sovereigns and USD IG, supported by resilient fundamentals and a more attractive risk-return profile.

For insights on how DWS tactically adjusts in a shifting global regime, consult the full portfolio perspective.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.