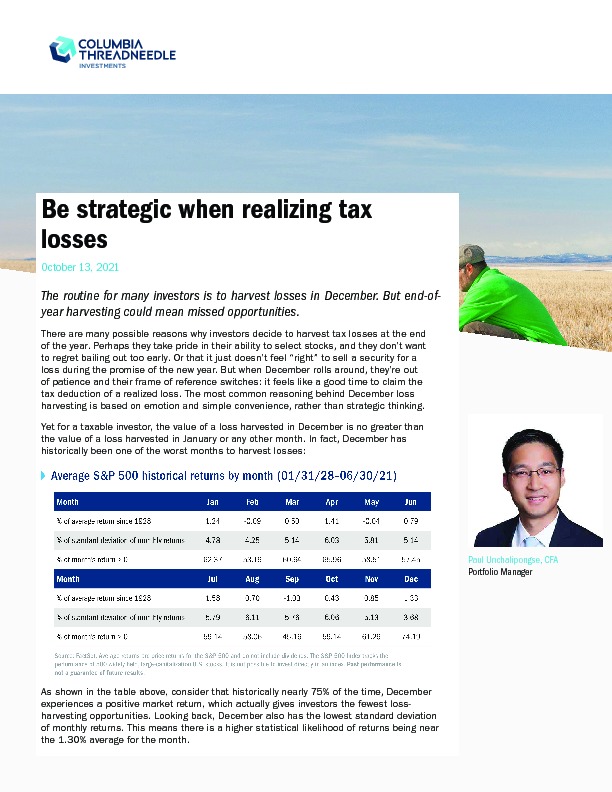

There are many possible reasons why investors decide to harvest tax losses at the end of the year. Perhaps they take pride in their ability to select stocks, and they don’t want to regret bailing out too early. Or that it just doesn’t feel “right” to sell a security for a loss during the promise of the new year. But when December rolls around, they’re out of patience and their frame of reference switches: it feels like a good time to claim the tax deduction of a realized loss. The most common reasoning behind December loss harvesting is based on emotion and simple convenience, rather than strategic thinking.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.