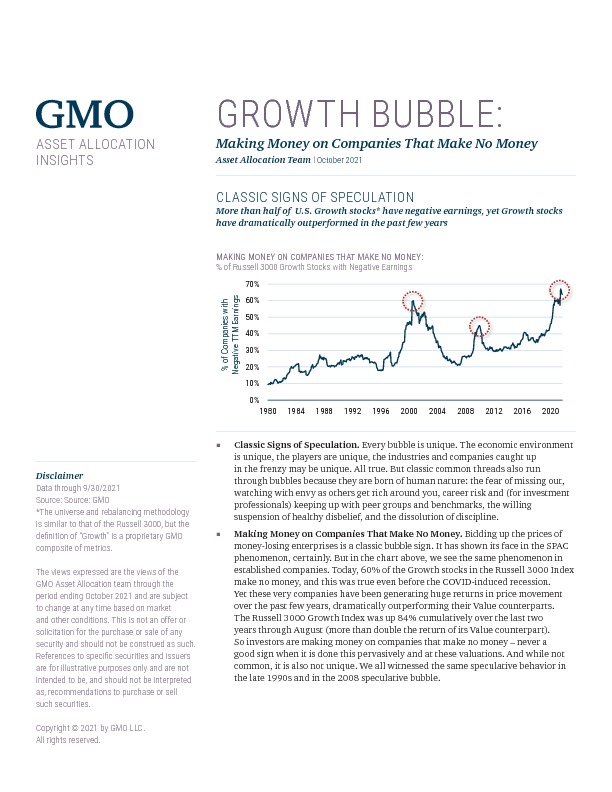

Every bubble is unique. The economic environment is unique, the players are unique, the industries and companies caught up in the frenzy may be unique. All true. But classic common threads also run through bubbles because they are born of human nature: the fear of missing out, watching with envy as others get rich around you, career risk and (for investment professionals) keeping up with peer groups and benchmarks, the willing suspension of healthy disbelief, and the dissolution of discipline.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.