Key points

- After more than a decade of litigations with holdout creditors, Argentina acknowledged US courts’ jurisdiction and offered to repay creditors. The country is returning to international capital markets after a 15-year absence.

- Argentina has issued US$16bn in new debt, mostly to settle with its holdout creditors.

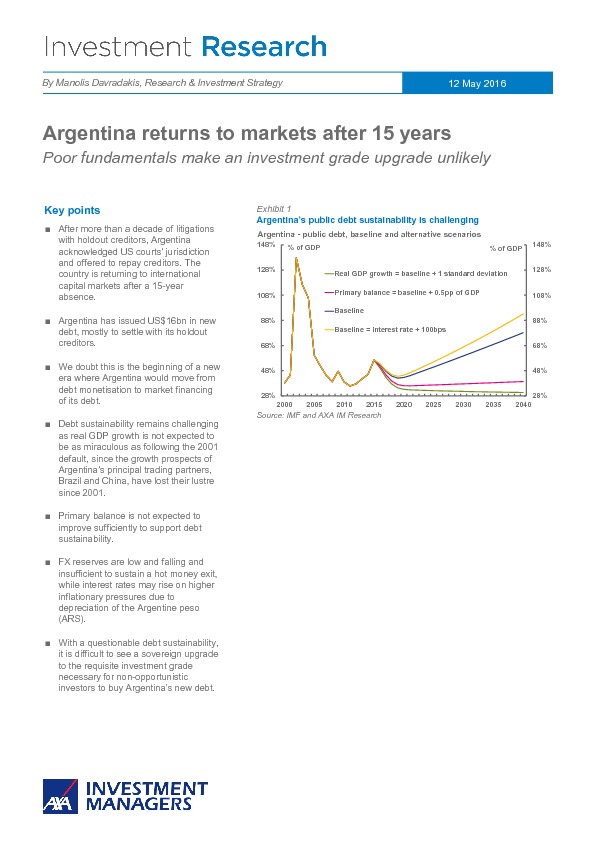

- We doubt this is the beginning of a new era where Argentina would move from debt monetisation to market financing of its debt.

- Debt sustainability remains challenging as real GDP growth is not expected to be as miraculous as following the 2001 default, since the growth prospects of Argentina’s principal trading partners, Brazil and China, have lost their lustre since 2001.

- Primary balance is not expected to improve sufficiently to support debt sustainability.

- FX reserves are low and falling and insufficient to sustain a hot money exit, while interest rates may rise on higher inflationary pressures due to depreciation of the Argentine peso (ARS).

- With a questionable debt sustainability, it is difficult to see a sovereign upgrade to the requisite investment grade necessary for non-opportunistic investors to buy Argentina’s new debt.