Lyxor - the Weekly Brief: Market Reversal Should Continue To Fuel Event-Driven Returns

The fourth quarter of 2015 started on a strong footing, reversing the previous market downturn. During the first week of October, risk assets rallied, with the MSCI World up 5.8%, following expectations that the Fed will postpone its first rate hike well into 2016. Implied equity volatility fell, the USD depreciated against major currencies, high yield spreads tightened, particularly in Europe, and commodities rallied. Finally, emerging markets received a breath of fresh air with the upturn in commodity prices.

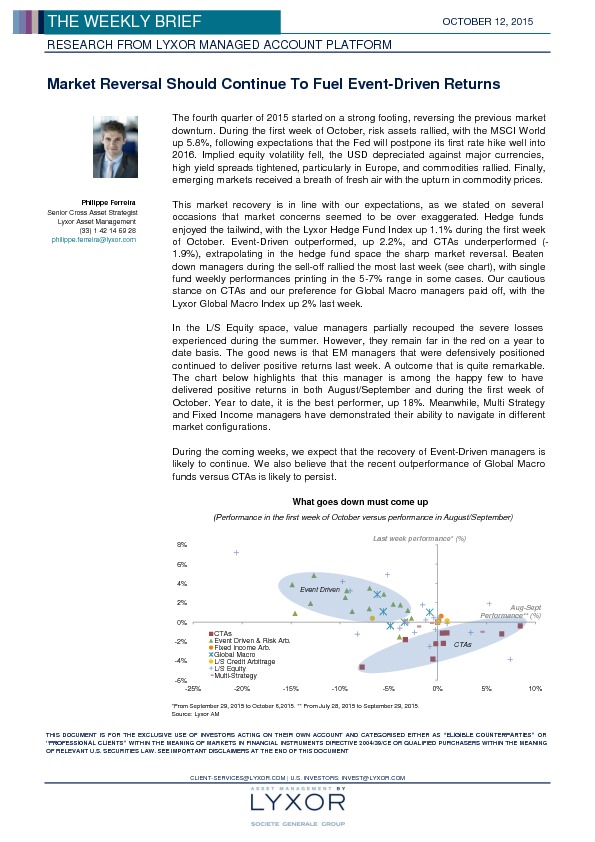

This market recovery is in line with our expectations, as we stated on several occasions that market concerns seemed to be over exaggerated. Hedge funds enjoyed the tailwind, with the Lyxor Hedge Fund Index up 1.1% during the first week of October. Event-Driven outperformed, up 2.2%, and CTAs underperformed (- 1.9%), extrapolating in the hedge fund space the sharp market reversal. Beaten down managers during the sell-off rallied the most last week (see chart), with single fund weekly performances printing in the 5-7% range in some cases. Our cautious stance on CTAs and our preference for Global Macro managers paid off, with the Lyxor Global Macro Index up 2% last week.

In the L/S Equity space, value managers partially recouped the severe losses experienced during the summer. However, they remain far in the red on a year to date basis. The good news is that EM managers that were defensively positioned continued to deliver positive returns last week. A outcome that is quite remarkable. The chart below highlights that this manager is among the happy few to have delivered positive returns in both August/September and during the first week of October. Year to date, it is the best performer, up 18%. Meanwhile, Multi Strategy and Fixed Income managers have demonstrated their ability to navigate in different market configurations.

During the coming weeks, we expect that the recovery of Event-Driven managers is likely to continue. We also believe that the recent outperformance of Global Macro funds versus CTAs is likely to persist.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.