At the G7 summit in June, leaders committed to a "green revolution" that would limit global warming to 1.5°C and reach net-zero carbon emissions by 2050. They also agreed to boost climate finance, which is b oth necessary and opportune as investors' desire to invest sustainably continues to break new records.

According to Morningstar, global assets in sustainable mutual and exchange-traded funds (ETFs) rose to nearly $2 trillion at the end of March 2021, up 17.8% on the previous quarter and nearly double the level a year earlier. Reassuringly for the G7 countries given the private investment required to reach their targets, ESG funds with an environmental or climate theme have been among the best-selling products of 2021.

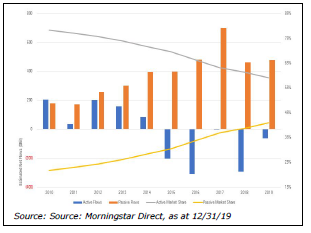

Another megatrend alongside the growth of sustainable investment has been the rise of passive investing. Over the past decade, passive funds globally received inflows of $3.8 trillion, compared to outflows of $185 billion for actively managed funds (see chart). The market share of passive funds has steadily risen over this period from 21.7% to 41.0% of total assets. There are also a growing number of indices available for these funds to track. According to the 2020 Index Industry Association (IIA) annual survey, over three million indices exist globally, 60 times more than the number of companies listed around the world.

Unsurprising, ESG-themed indices are the fastest growing segment of the market. Globally they rose by 40.2% in the past year according to the IIA – the largest year-on-year increase in any single major index class in the survey’s four-year history – following growth of 13.9% from 2018 to 2019. While the rapid expansion is positive in steering capital flows towards more sustainable funds, with three providers – FTSE Russell, S&P Dow Jones and MSCI – representing over two thirds (68.3%) of market share, it also raises questions about their construction, potential conflicts and use by investors.

Passive in name only

According to the Cambridge Dictionarystudy"Index investing is better understood as a form of delegated management, where the delegee is the index creator rather than the fund manager… The fact that an investor “passively” follows an index does not imply that the index itself is passive.", passive is defined as "not acting to influence or change a situation; allowing other people to be in control". However, a recent 7 of US equity indices and the 'passive' funds tracking them found that a significant amount of decision-making was being entrusted to index creators by fund managers:

For investors, the quality and transparency of the decision-making being delegated to index providers is important, particularly as the study found there to be wide-ranging differences between similar strategies:

"There is a tremendous amount of diversity across indices, even among indices that purport to have similar aims. Far from being passive, these indices represent the deliberate decisions made by their managers."

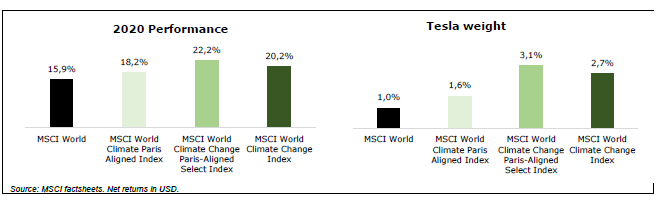

The author concluded that this delegation has far-reaching implications for the two principal uses of indices. First, as a measurement for performance. Indices that appear alike can perform very differently, particularly for specialist or complex benchmarks that require many inputs and greater subjectivity in their construction. This is illustrated by the wide-ranging returns of three similarly named MSCI World climate indices last year, largely driven by their different exposures to Tesla (see chart below). For investors measuring returns and risk on a relative basis, this makes the selection and understanding of an index very important.

Second, and perhaps more importantly, as the basis for "passive investing" where capital is allocated according to the rules of the index provider. For mainstream indices based largely on market capitalisation, these rules are relatively uniform and well-understood, resulting in little difference between index providers. For ESG indices, however, and climate ones in particular, investment decisions with important ramifications are being delegated to index providers who eschew scientific analysis, fundamental research or due diligence.

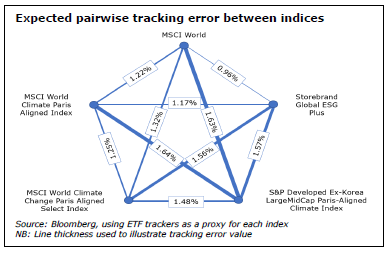

Instead positions and weightings are based on subjective decisions which create significant differences in risk as well as return. Tracking error analysis of 'Paris-aligned' indices shows that they are as different from each other as they are from the MSCI World Index (see chart). This underlines how the choices behind each strategy really matter and investors must understand them to decide which selections they prefer, rather than simply delegating this decision to their default index provider.

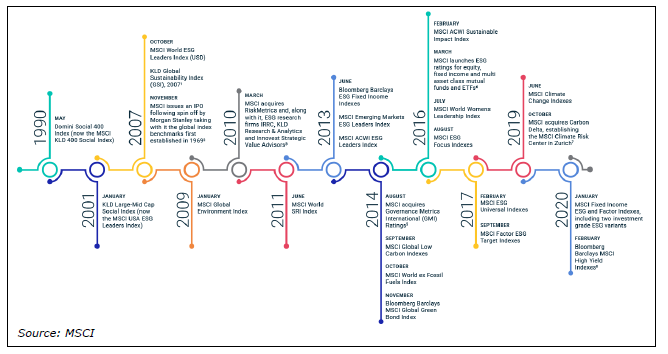

Another issue is that indices reflect the best available set of decisions at the time they are created. Climate change is evolving rapidly, with new insights, policy and data becoming available as time passes. An index-based strategy is static by construction, and therefore quickly becomes outdated. Creators therefore release new strategies, which successively enjoy a brief window as the 'latest and greatest' before the process repeats itself. MSCI alone currently offers over 1,500 ESG indices, which it has launched over the last thirty years:

As a result, investors must frequently reinvest into newly launched index trackers to remain exposed to the best available strategy, incurring costs and possibly increasing their tax burden. Delegation to a passive manager or an index is equivalent to entrusting an active manager – it requires the same level of due diligence and trustee governance.

Index creators do not know before an index is launched how liquid it must be to accommodate the unknowable future level of assets that will track the benchmark. They make a best guess but if they underestimate demand, it can lead to spectacular rebalancing requirements. In March, S&P Dow Jones was forced to broaden its Global Clean Energy Index from 30 to 77 stocks when two BlackRock ETFs tracking it experienced huge investor inflows in order to avoid the asset manager holding excessively large positions in the smallest index constituents. The details of the rebalancing were subject to public discussions and investors in the ETFs could well have suffered significant financial losses due to the front-running activity of hedge funds and other investors exploiting the situation.

The issue was particularly surprising as the index was created specifically for the two BlackRock funds, which highlights the second major finding of the US study. It discovered that of the 571 ETFs analysed, 81 tracked indices affiliated to the fund provider. This represents a conflict of interest and creates risk management issues given these ETF providers are effectively delegating active investment decision-making to themselves.

EU disclosure

In 2019 the EU published its final report on climate benchmarks and ESG disclosures in an effort to improve comparability among benchmark methodologies, provide investors with an appropriate tool to align their investment strategy, increase transparency on impact particularly with regard to climate change and the energy transition, and disincentivise greenwashing. It defines a Paris-aligned benchmark as "where the underlying assets are selected in such a manner that the resulting benchmark portfolio’s GHG emissions are aligned with the long-term global warming target of the Paris Climate Agreement and is also constructed in accordance with the minimum standards laid down in the delegated acts."

According to Morningstar, there were 400 climate-themed mutual and exchange-traded funds globally at the end of 2020, with over 70% in EuropeIt is therefore to be hoped that the EU's initiative will bring about greater standardisation among index providers and the growing number of funds which track them.

Finally, the investable universe for Paris-aligned indices is limited to broader market capitalisation-based benchmarks. These exclude many climate solutions companies, limiting opportunities and creating large individual stock risk for those they do include. Paris alignment must be about investing in solutions and the new low carbon economy as well as decarbonising the existing economy.

In conclusion, contrary to conventional wisdom that 'passive' should mean no – or only insignificant – decisions being made by delegees, the reality for ESG index providers is different. Decisions that have material financial and environmental consequences are being actively delegated to the them without adequate disclosure or – for climate-related indices – expertise.

While passive investing in its purest 'buy-and-hold' form is unsuitable for a world where climate data and science are ever-changing, labels matter. Just as closet indexing has faced regulatory scrutiny, we believe investors should face the same protection against 'closet active' investing, given its prevalence and ramifications in terms of both financial risk and return. Until then, it is incumbent on asset managers to understand and explain the decisions that the index providers – whom they are delegating them to – are failing to do.

In April 2017 Storebrand launched Storebrand Global ESG Plus. A fossil-free global equity fund which aims to provide long-term capital growth through a model-based portfolio of developed market equities. The fund is managed systematically and seeks to reproduce the risk and return profile of the MSCI World Index whilst aligning with the low carbon transition. The fund excludes fossil fuel-related and climate negative companies, invests in climate solutions and is managed with additional ESG criteria and a sustainability focus.

If you would like more information on Storebrand Global ESG Plus or our other sustainable funds please visit

https://www.storebrandfunds.lu/ or contact us on

e-mail: michel.ommeganck@skagenfunds.com

Mobile: +4790598412

1 Morningstar, Global Sustainable Fund Flows: Q1 2021 in Review, April 2021

2 Morningstar Direct, January 2020

3 IIA Fourth Annual Survey, October 2020

4 World Federation of Exchanges, 2020 Market Highlights

5 Burton-Taylor, May 2021

6 Cambridge Dictionary

7 Adriana Robertson, Passive in Name Only: Delegated Management and "Index" Investing, 2021

8 MSCI, ESG Milestones, April 2020

9 S&P Global, April 2021

10 EU, TEG final report on EU climate benchmarks and benchmark ESG disclosures – September 2019

11 Morningstar, Investing in Times of Climate Change, April 2021