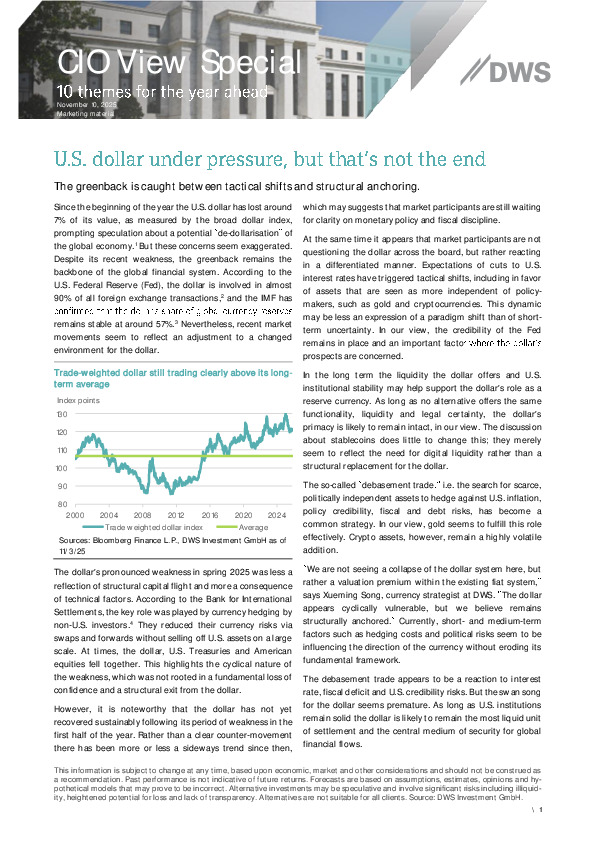

DWS’s CIO View Special analyses the dollar’s 7% decline this year and argues that recent volatility reflects tactical repositioning rather than a structural erosion of the greenback’s global role.

-

Cyclical Pressure: FX hedging by foreign investors—not capital flight—drove 2025’s dollar slump, while rate-cut expectations keep short-term sentiment cautious.

-

Shift to “Debasement Trades”: Gold and crypto have benefitted from uncertainty, but these flows signal risk-hedging, not a systemic shift away from the dollar.

-

Structural Anchors Hold: The dollar’s unmatched liquidity, legal certainty, and institutional stability continue to underpin its reserve-currency dominance.

Dive into the full report to explore the tactical drivers, long-term fundamentals, and what they mean for currency strategy.